Retirement calculators can help you plan for the future. And over the last few years, there have been a number of them developed that all offer slight variations and tools.

Saving and investing for retirement is a long-term project best tackled over decades. If you want the tailwinds of compounding growth, you need to invest for retirement early and often.

However, generic advice doesn’t answer most people’s biggest retirement questions. You want to know how much you need to save each month, what age you can retire at, whether your investment portfolio is likely to run out, and what you can afford to do along the way.

That’s where retirement planning calculators come in. Whether you’re just starting to invest for retirement, or are planning to exit the workforce within a year or two, you can benefit from a retirement calculator.

Best Retirement Calculators For 2024

We’ve tested close to 20 retirement calculators and chosen our favorites for 2024. You can see the full list (in ranked order) later in the article, but here are our top picks, starting with the T.Rowe Price Retirement Income Calculator (it's free).

Best Overall Retirement Calculator: T.Rowe Price

With a near-perfect score on usability, a sophisticated approach to analysis, a deep level of customization, and a free price tag (which was the tie-breaker), the T. Rowe Price Retirement Income Calculator was our top pick for the best overall retirement planning calculator. The questions it asks are detailed enough to give you a clear idea of whether you’re on track to retire, but high-level enough to get your answer in under five minutes.

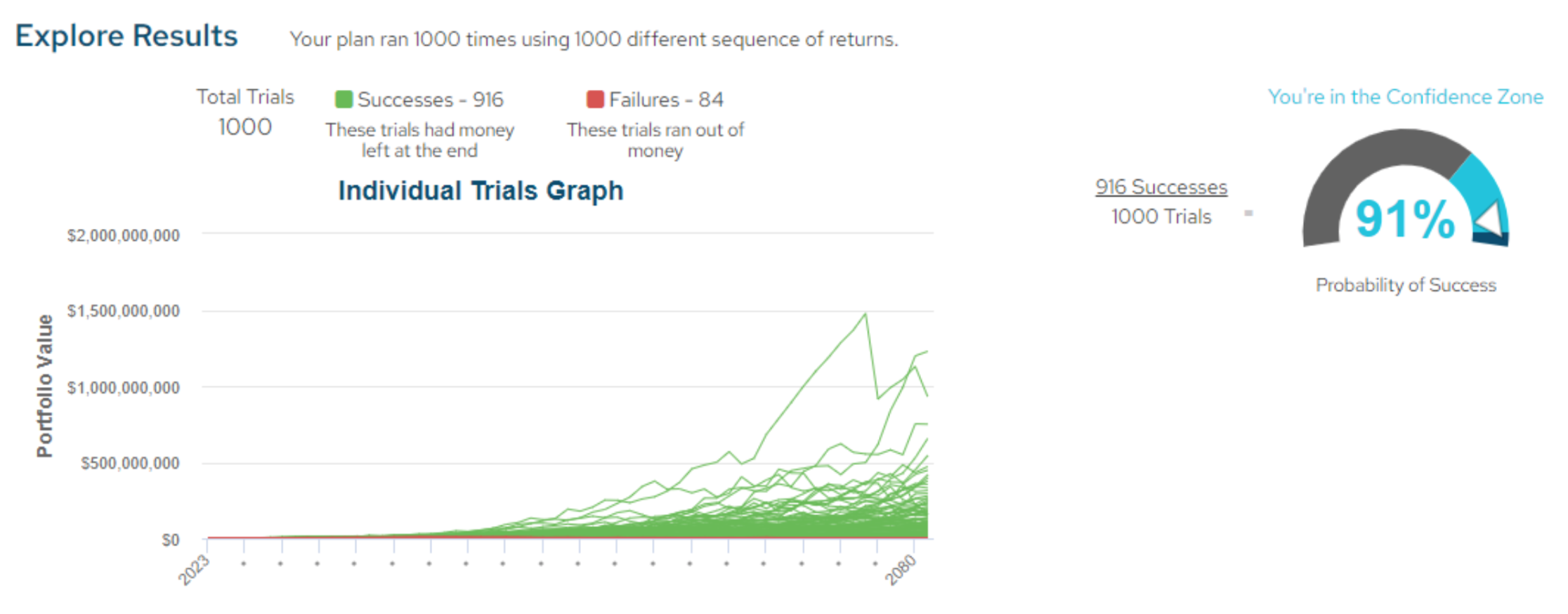

The T. Rowe Price calculator uses Monte Carlo simulations to help you understand if you’re likely to meet your retirement goals or not. It also allows you to “play” with your assumptions (increasing savings rates, retiring earlier or later, adding cash infusions, etc.). This provides a dynamic retirement calculator that isn’t overly burdensome.

The calculator focuses exclusively on retirement, so you shouldn’t use it for all your financial planning needs. But if you’re wondering whether you’re on track to retire, it will help you find the answer.

Best Free Retirement Planning Tool: Empower

While the T. Rowe Price retirement planning calculator answers whether you can retire, Empower helps you dig into your retirement planning questions. Empower allows you to do detailed scenario planning based on your actual financial situation. By using real-time data from your financial accounts (including your spending accounts), you can dig into real details instead of hypotheticals. Even better, the tools are free to use, and Empower lives on your phone or computer, so you can review the results at your leisure.

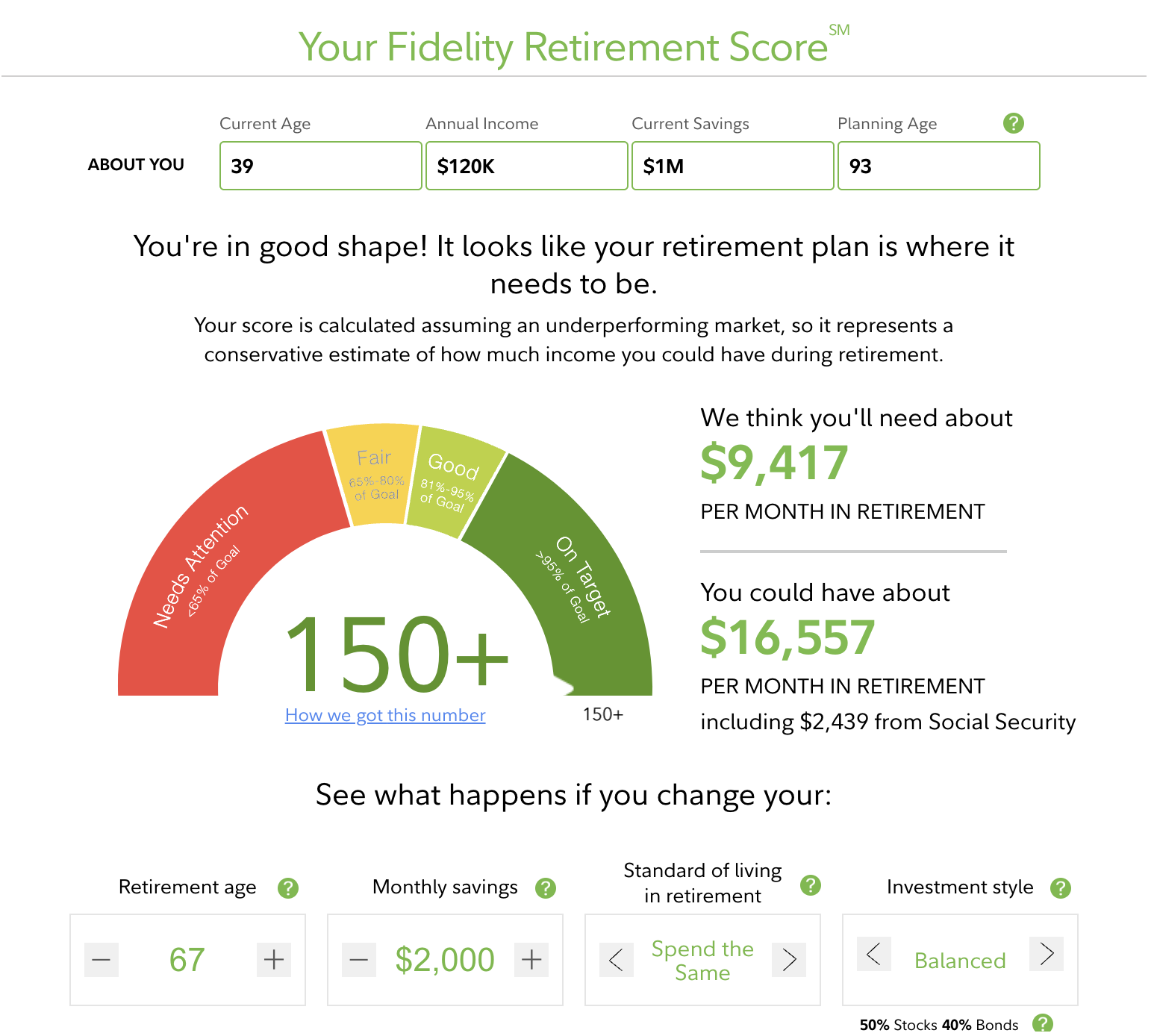

Best For Quick Analysis: Fidelity's Retirement Score

By answering six quick questions, you can receive Fidelity’s Retirement Score. The score shows the probability that your money will outlive you (based on your responses to the questions). If you’re not planning to retire in the next few decades, Fidelity’s calculator lets you know whether you’re on track for retirement. It’s not designed for detailed retirement planning, but it will show you if you need to save more aggressively, or if you can take your foot off the gas.

Best For Total Life Planning: Maxifi

Maxifi takes the prize for best total life planning tool. It integrates tax planning, life events, and changes to income and expenses into a comprehensive financial and retirement plan. It takes your current financial goals as seriously as your future retirement goals.

Maxifi costs $109 per year, but it's money well spent if you use the software to make better financial decisions. If not, don’t waste your money and time digging into the tool.

A few years ago, very few companies offered comprehensive financial planning for everyday people. In this analysis, we reviewed four easy-to-use tools that give you the flexibility to consider all sorts of life events in your analysis. All five received scores that allowed them to tie for second place overall. In addition to Maxifi, ProjectionLab, New Retirement, and OnTrajectory all offer sound financial planning tools that allow you to consider retirement along with the rest of your life. We happily recommend any of these tools for personal finance aficionados who want to answer life’s biggest financial questions.

Retirement Planning Calculators Details

Below is a full list of the retirement planning calculators that we tested — their usability ratings, prices, and the final score assigned to them. Some scores indicate a multi-way tie, but the descriptions above provide more detail on why certain tools were ranked above others.

Tool | Description | Usability | Price | Score |

|---|---|---|---|---|

Robust calculator estimates whether your portfolio can support your retirement needs, and allows you to play with your assumptions. It uses Monte Carlo simulations to provide an estimate of the frequency that your portfolio will last for your entire life. | 19/20 | Free | 25/30 | |

| A premium financial planning software designed to help you make better decisions today without jeopardizing your future goals. Maxifi provides deep insights into the risks and rewards of dipping into your savings to meet a short-term goal vs. holding off. | 15/20 | $109/yr | 25/30 |

Financial planning software that not only provides detailed retirement projections, it also helps you track progress toward important life goals along the way. If you want to understand how big lifestyle decisions will affect your retirement, OnTrajectory can help. | 15/20 | $80/yr | 25/30 | |

Fully customizable financial planning software for people who are pursuing Financial Independence and early retirement. Allows you to account for large expenses (children's college, home upgrades, etc), changes in income, spending, and more. Click here to read our ProjectionLab Review. | 15/20 | $108/yr | 25/30 | |

Comprehensive financial planning software offering detailed financial plans even with the free version. The upgraded version allows you to plug in hundreds of financial details to personalize your plan. Click here to read our NewRetirement Review. | 15/20 | $120/yr | 25/30 | |

Retirement planning, budgeting, and net worth tracking app. Connect your financial accounts to the app, and build a financial plan based on your actual account balances. Click here to read our Empower Review. | 16/20 | Free | 23/30 | |

A simple calculator that forecasts your expected retirement needs, and your likelihood of meeting them. Limited ability to play with the numbers and there are lots of assumptions related to returns and inflation. Nonetheless, a great tool for those who just want to know whether they are on track. | 20/20 | Free | 23/30 | |

A retirement calculator based on your current spending and your expected spending in retirement. For people who want to do financial planning on their own. If you don't have a detailed understanding of your current spending, this is probably not the right tool for you. | 14/20 | $95/yr | 23/30 | |

A Monte Carlo simulator designed to help early retirees decide when their portfolio is large enough to support their retirement needs. You can model dozens of scenarios to help you decide whether you can leave your job to retire. | 13/20 | Free | 22/30 | |

The Financial Mentor's Ultimate Retirement Calculator answers the big retirement questions. If you're starting to get a handle on your financial details, this calculator can show you whether you're on the path toward a financially sound retirement. You may need to dig around to find details like your tax rate, but once you know these details you can build a simple but sound retirement plan. | 14/20 | Free | 21/30 | |

| A simple calculator designed to help you figure out the balance between spending and saving for retirement. The tool is easy to use, but doesn't offer much in the way of customization (unless you want to change your inputs). | 16/20 | Free | 20/30 |

Super simple retirement calculator that shows your expected nest egg at retirement, and how much you're expected to need. The calculator is simplistic, but if you're new to investing or thinking about retirement, it can give you a directional take on whether you're on track to retire. Click here to read our Stash Review. | 17/20 | Free | 19/30 | |

WalletBurst offers a simple look at the relationship between your spending, your assets, and your ability to retire. If your main question is when you can quit your job, WalletBurst is the tool for you. | 12/20 | Free | 18/30 | |

The Complete Retirement Planner helps you create a personalized retirement plan based on your current financial situation and your retirement aspirations. It allows for detailed planning, but it is best suited for people who already have a good understanding of their finances. | 7/20 | $89.99/yr | 16/30 | |

Using simple assumptions, the AARP Retirement Nest Egg Calculator calculates a monthly savings rate required to retire at a specific age. Unfortunately, the built-in assumptions seem to be biased towards very low returns (especially during the retirement years). Compared with other calculators, the tool may suggest too large of a required nest egg. | 12/20 | Free | 15/30 | |

One of the original tools designed to help early retirees decide whether they can retire. The calculator uses tons of data and allows you to model many different scenarios. However, the user interface is stuck in 2002, and the jargon makes the calculator hard to use. | 4/20 | Free | 12/30 |

A Few Caveats About Our Judgment Criteria

Each calculator presented in this article had to meet certain “table stakes” criteria to be included. These criteria include having clear and fair assumptions (especially related to investment growth and inflation).

Calculators using simple assumptions (such as not accounting for volatility) were allowed as long as assumptions surrounding growth and inflation were displayed. Such calculators are best for people with two decades or more until retirement.

It also needed to provide details about an investor’s expected net worth at retirement and their portfolio’s expected longevity following retirement. Calculators that didn’t provide both of those details were excluded. We also excluded tools that require you to have a retirement account with the brokerage in order to use the tool.

If the calculator met these criteria, it was allowed into the list of considered tools. At that point, the most important criterion for judging these calculators was usability for the average person. This accounted for two-thirds of the overall score. A typical person should be able to jump into the calculator and get understandable results using reasonably accurate estimates of their financial situation. Any calculator that required users to wade through jargon or text-heavy pages was discounted on the usability front.

The other criterion for judging the calculator was robustness. Calculators that accounted for more investment scenarios, better refinement of assumptions, or better simulations of risk were deemed better than those with fewer options. Most calculators allow you to “play with your assumptions” to see what you can get on track for retirement. But that’s only the first part of robustness. You may also want to see how your current decision (to upgrade a house, have a child, take time off of work, etc.) is likely to affect your retirement plan. Some calculators allowed you to do this, but others didn’t.

While robustness is important, it only accounted for a third of the overall score for several reasons. First, most people don’t need incredibly detailed financial retirement calculations until the decade before they retire. Unless you’re pursuing extremely early retirement, you probably don’t need a detailed financial calculator until you’re 50-60 years old. Additionally, most people won’t use the refinement features. A few curious people may use the refinement features based on their current life goals, but most people won’t. If you’re someone who rigorously tracks your net worth or religiously uses your budgeting app, you may find it hard to believe that people don’t love spending time on financial tools. However, most people who want a robust analysis will pay a financial planner for an analysis rather than research tools themselves.

Retirement Calculator Wrap-Up

No matter which retirement calculator you choose, you should always spend sometime each year on your retirement plan to help you stay on track. You may not need to build a comprehensive plan, but a high-level retirement target can help you live well today and tomorrow. If you’re more focused on your day-to-day personal finances consider using one of these budgeting apps and these investing apps to help you take daily steps to build your financial health.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington