Empower (previously known as Personal Capital) has been a leading money management tool for the last few years. They offer great spending and investment tracking, all for free. They also recently launched an online savings account with a compelling yield.

My personal love affair with Mint is now over. It's still a great free money management tool, but I've always had a negative view about how Mint handled investments and now they shutting down anyway. It just didn't do enough for my investments to really help me in my personal finances. nd since investing is such a big part of my finances, I always relied on Quicken instead.

But in my continued quest to move my finances to the cloud and looking for Quicken alternatives, I've found a free tool that really nails everything Mint does, PLUS investments. It's called Empower.

See why we like this tool in our Empower review. Plus, learn about their upsells and their new compelling cash account as well. And see how they compare to the other top money and financial tracker apps out there.

Empower Details | |

|---|---|

Product Name | Empower |

Pricing | Free To Try, 0.89% AUM |

Platform | Online, Mobile App |

Cash Account Yield | 4.70% APY |

Promotions | None |

What Is Empower?

Empower is both a budgeting app and financial tracking tool, as well as an investment manager. They are most well known for their financial dashboard - where you can track your spending, budget, monitor your investment portfolio, and more. The best part is that this tool is currently free.

They are also a professional investment manager, where you can meet with a financial planner and allow them to manage your portfolio for a fee. They effectively use their free dashboard as a lead generator for their investment management services.

Empower (which as previously known as Personal Capital) was founded in 2010, and was acquired by Empower Retirement in July 2020.

In 2023, Personal Capital was rebranded as Empower.

Empower was also named one of the best budgeting apps of 2024!

What Empower Has

The reason I loved Mint for so long is because it automatically updates and categorizes your transactions for you. You always get an up-to-date picture of your spending, and you can see where your money is going.

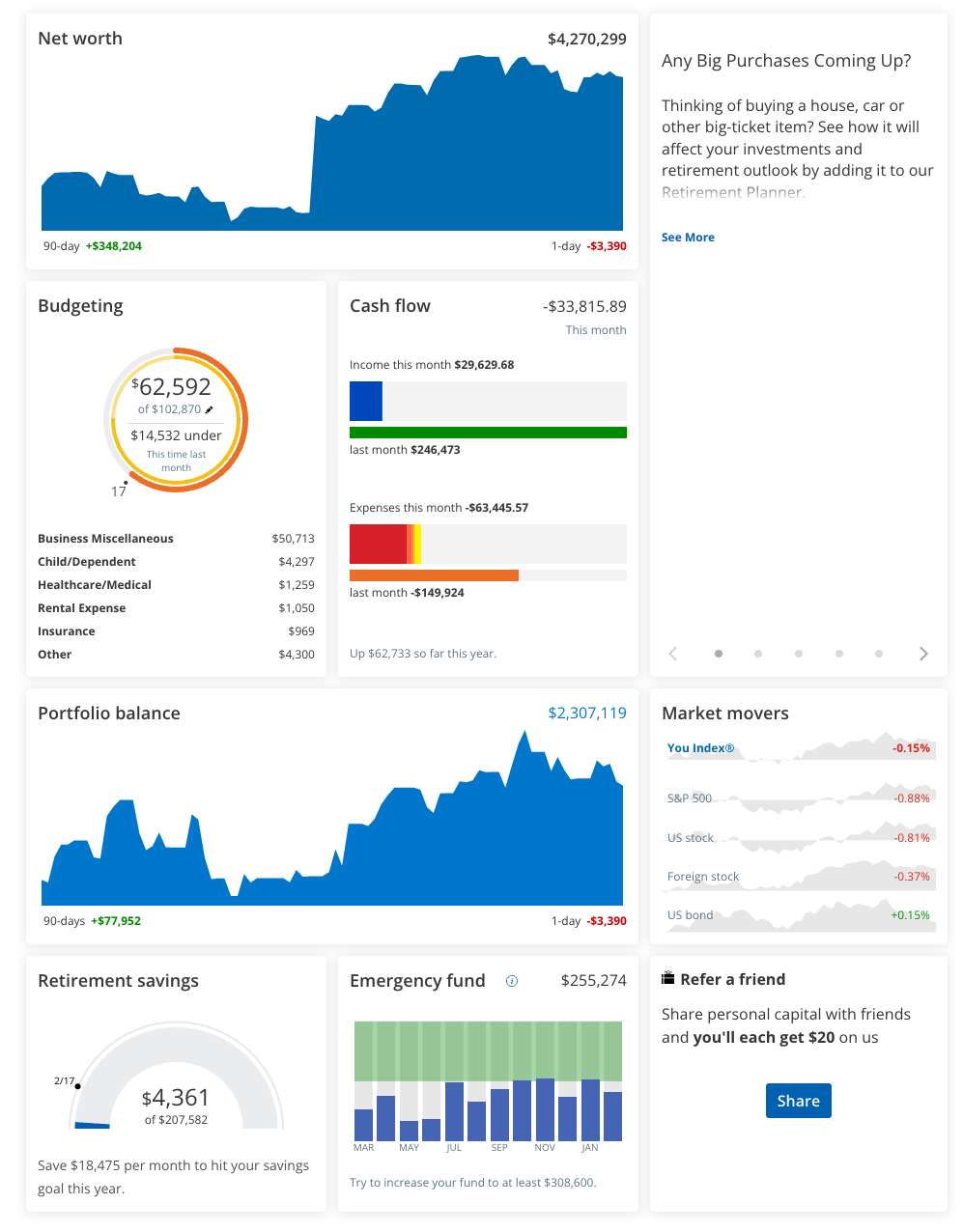

Empower covers all the bases. When you log-in, you're greeted with a dashboard that is very similar to Mint. On the left side, you can see all your accounts listed, as well as your total net worth at the top. Empower connects with all the same banks and institutions as Mint, and also lets you add asset accounts, like your house. Then, you get to see a dashboard that includes the following:

A basis of your spending:

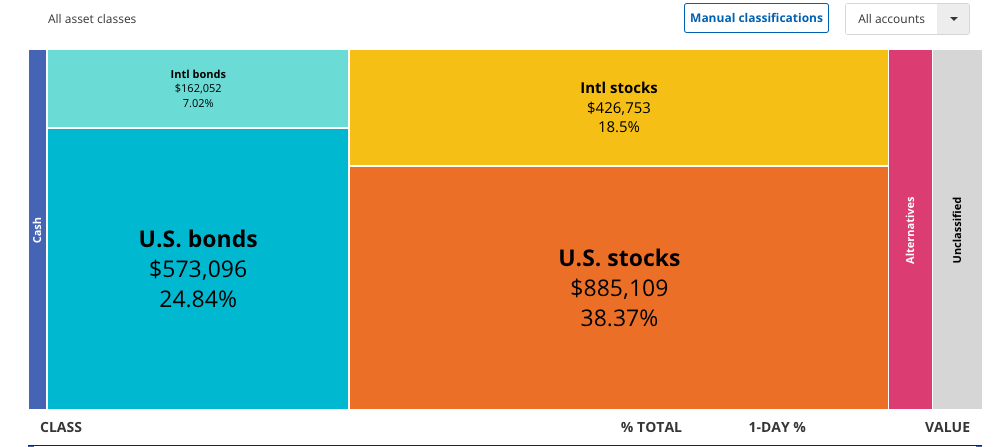

They also have an overview of how your portfolio is performing versus the total market:

They also have a helpful asset allocation tool:

They also have helpful budgeting and spending tools. You can see your cash flow each month, as well as a breakdown of your spending categories.

You can find this in the "Budgeting" tab.

Related: The Best Portfolio Analysis Tools

Investing Tools

The best part of Empower are the investing tools, which are simple, yet much more powerful than what Mint was offering. Empower does investment management right, but focusing on a few basic things:

- The Value of Your Portfolio

- The Performance of Your Portfolio (as a whole and of each individual investment)

- An Overview of Your Holdings

- An Analysis of Your Allocation

- Good Transaction Management

What always frustrated me about Mint (and sometimes Quicken) was the transaction management. So far, I've found Empower to be excellent at correctly managing all imported transactions from my brokerages. For one asset, they didn't get the symbol (due to the fact it is in a transfer company, not a brokerage), but I was manually able to input the symbol.

How Does Empower Compare For Budgeting And Net Worth Tracking?

Empower offers both their free dashboard and net worth tracking, as well investing advice. We'll cover the investing advice below, but since most people simply use their free dashboard, we thought we'd compare just the dashboard first.

Empower's dashboard is a great option for those looking to track both spending and investing. Mint was a close runner up until it shutdown, as well as Quicken (however, Quicken is a paid product). Another runner up is Monarch, which has been developing a lot of great tools to compete - but it's also paid. YNAB is another very popular option, but it's different in its approach. See our full YNAB vs. Empower comparison here.

If you're looking at simply net worth tracking, Kubera is a solid option.

The trouble with "free" is that these companies cannot sustain all the costs of running this type of software with connections to the various platforms. It costs roughly $0.005 per month, per account, for every connection. Considering someone like myself has upwards of 20 connections (banks and brokerages), that's $0.10 per month. Doesn't sound like much, but it can add up really fast!

Hence, Empower is one of the last of the free tools - because you are actually the product. They're going to try to sell you on investment management (see below).

If you're simply looking to compare their free dashboard, here are some of the options. See the full list of Mint Alternatives here.

Header |  | ||

|---|---|---|---|

Rating | |||

Price | Free | $99.99/yr | $98.99/yr |

Budgeting Features | Good | Good | Strong |

Investment Tracking | Good | Limited | Limited |

Banking? | |||

Cell |

Investing Advice

To me, it is always important to know how a company offering a free service makes money. And Empower makes money by promoting their financial advisers to help you with your portfolio. Their goal is to eventually get you as an asset management client - and once you cross $100,000 in assets, you can expect their advisors to begin calling you and encouraging you to meet with them to review your portfolio.

If you decide to work with them, they do charge (quite a bit) to manage your portfolio. While their fees are all inclusive, you can expect to start paying 0.89% AUM (assets-under-management) if you have less than $1,000,000 invested with them.

They actually call you different levels based on how much you have invested:

- $100,000 to $200,000: Investment Services Client

- $200,000 to $999,999: Wealth Management Client

- Over $1,000,000: Private Client

As you have more funds invested, your AUM goes down. Once you hit "Private Client" status, you'll start saving a little in AUM fees. However, it is tiered:

Balance | AUM |

|---|---|

Under $3M | 0.79% |

$3M to $5M | 0.69% |

$5M to $10M | 0.59% |

Over $10M | 0.49% |

How Does Empower Wealth Management Compare?

Honestly, Empower's Wealth Management services are more expensive than other companies. While they have a great free dashboard, they investment services are expensive than other companies. They're not a robo-advisor, but they're also more expensive than other firms who do direct human-assisted investing.

Here's how they compare to some of their main competitors.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Annual Fee | 0.89% | 0.25% | 0.30% |

Min Investment | $100,000 | $500 | $50,000 |

Advice Options | Human | Auto | Auto and Human |

Banking? | |||

Cell |

Empower Cash

Empower recently announced Empower Cash. This is a cash management account, and it acts like a high yield savings account.

The Empower Cash account yields 4.70 APY - which is a very compelling offer. The account is also FDIC insured, and since it's a cash management account, there are no transaction limits on deposits or withdrawals.

If you're a Empower Advisory client, you actually can earn a higher rate (0.10% more) - 4.80% APY.

Why Should You Trust Us?

I have deep experience with using "Personal Financial Managers" or PFMs like Empower. I started using Quicken in the early 2000s to track my personal finances, and since then, I've used or tested almost every budgeting app and investment tracking app in the marketplace.

I've spent over hundreds of hours using Empower for both testing and tracking my own finances - using both the web version and app version on my iPhone.

Combine my personal experience with that of our amazing team of editors and testers, and we have over 100 years of combined experience using, reviewing, and testing budgeting apps and tools!

Who Is This For And Is It Worth It?

Don't just take my word for it - see for yourself. Just like Mint, Empower is free. It only takes a matter of minutes to input your bank logins and get your data live. Empower even advertises it will take just 29 seconds if you have one account to add.

If you're not sold on Empower, check out these Mint Alternatives that might work for you.

Spend 29 seconds right now and check out Empower, and then leave your thoughts below! I'd love to hear what you think about this product.

Empower Review

-

Product Cost

-

Ease of Use

-

Tools and Features

-

Customer Service

Overall

Summary

Empower (formerly Personal Capital) is a free financial dashboard that offers great tools to help you track spending, monitor your net worth, and track your portfolio. It also offers an investment management service that costs above-average.

Pros

- Great free net worth and spending tracker

- Solid free options for portfolio analysis

Cons

- Their wealth management service costs above-average at 0.89% AUM

- The financial dashboard has been known to suffer from connectivity issues with client banking and investment firms

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett