Best Retirement Calculators For Projecting Savings

Retirement calculators can help answer your biggest questions, including how much money you need to retire. These are the best retirement calculators right now.

Learn about investing for retirement and how you can apply these strategies to your own portfolio.

Retirement calculators can help answer your biggest questions, including how much money you need to retire. These are the best retirement calculators right now.

Do you own a business in which you are the only employee? If so, you might be eligible for the solo 401(k) auto-contribution tax credit.

The 401(k) is not a scam, but it is important that you understand how it works so you can take advantage of the benefits and avoid the pitfalls.

The main difference between an IRA vs. self-directed IRA are the assets you are able to invest in. You have more options with a SDIRA, but they are expensive.

We break down the best self-directed IRA providers if you’re looking to invest some of your retirement savings in alternative assets.

The Entrust Group provides self-directed retirement accounts, including IRAs, 401(k)s, HSAs, and ESAs. Learn more in this Entrust Group Review.

After-Tax 401k contributions can help you shelter more of your money from taxes. But what is an after-tax 401(k) and who qualifies? Learn more.

Carry is a financial planning platform that offers a self-directed solo 401(k) plan, traditional and Roth IRAs, and courses that can help business owners.

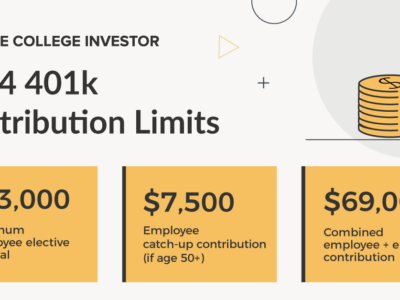

401(k) limits increase each year. If you want to max out your retirement account, check out the 2024 401(k) contribution limits.

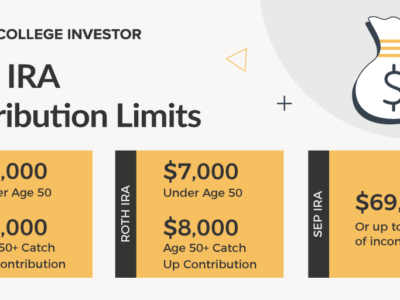

Contribute to an individual retirement plan like a Roth IRA or Traditional IRA? Here are the 2024 IRA contribution limits.

Discover the 2024 403b contribution limits, catch-up contributions, factors affecting limits, and tips to maximize your retirement savings.

The College Investor is an independent, advertising-supported financial media publisher, focusing on news, product reviews, and comparisons.