How To Start Investing

If you're ready to take control of your financial future, and want to build real wealth, investing for the long term is the best way to do it. If you have $100, and want to start building wealth, then you're ready to learn how to start investing.

We have all of the tools you need to learn how to invest - no matter your age, financial literacy, or money. We also can educate you on all different types of investments - from long term mutual funds and ETFs, to cryptocurrency, to investing in real estate.

We also have tools for people that don't want to DIY it. We share the best robo-advisors that you can use to put your investments on auto-pilot.

Sign Up For Our FREE Investing 101 Course And Learn How To Start Investing Below:

Guides To Start Investing

No matter what your age, here are our guides to learn how to start investing:

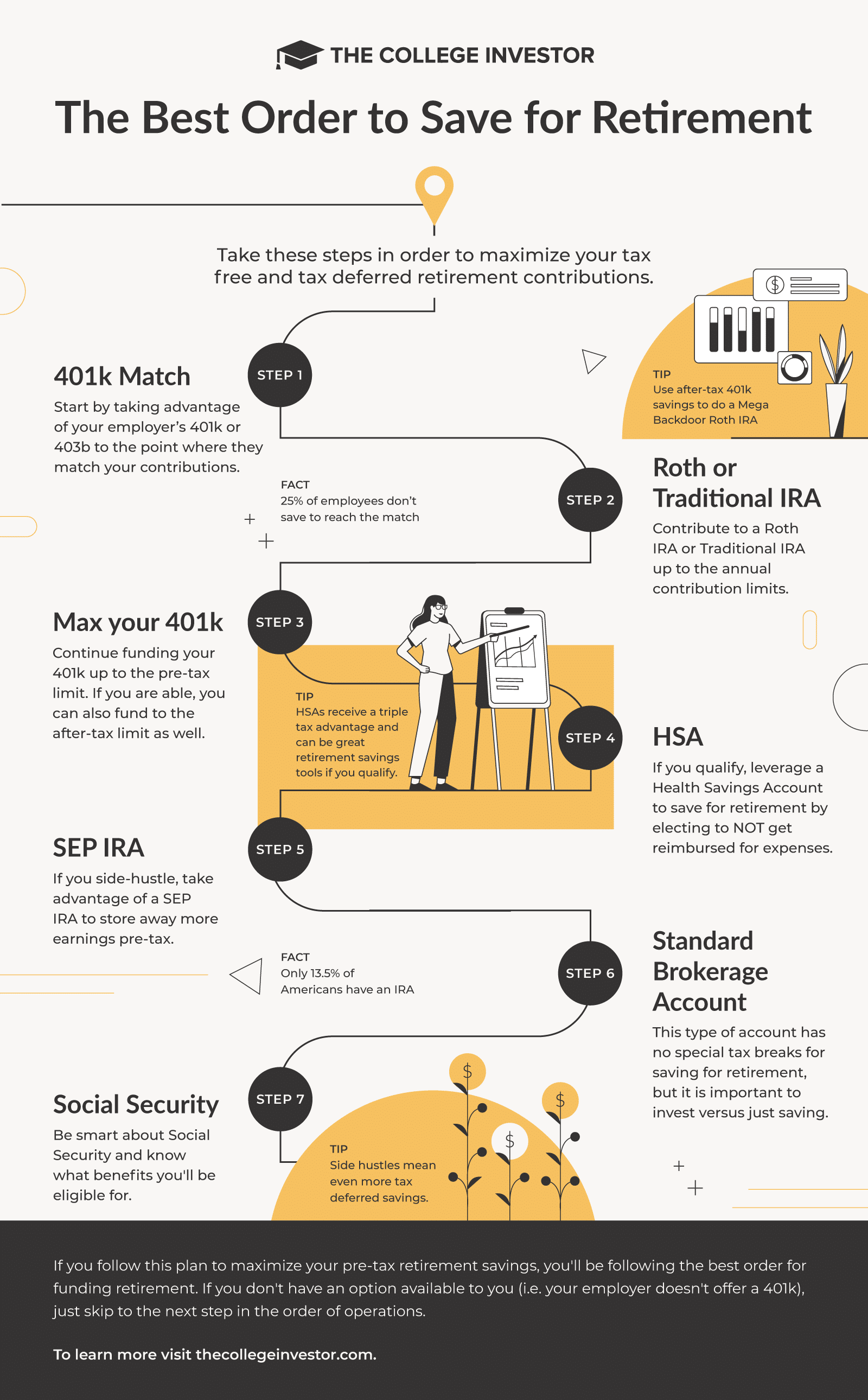

Make sure that you also check out our Order of Operations for Investing if want to know the best account types to start.

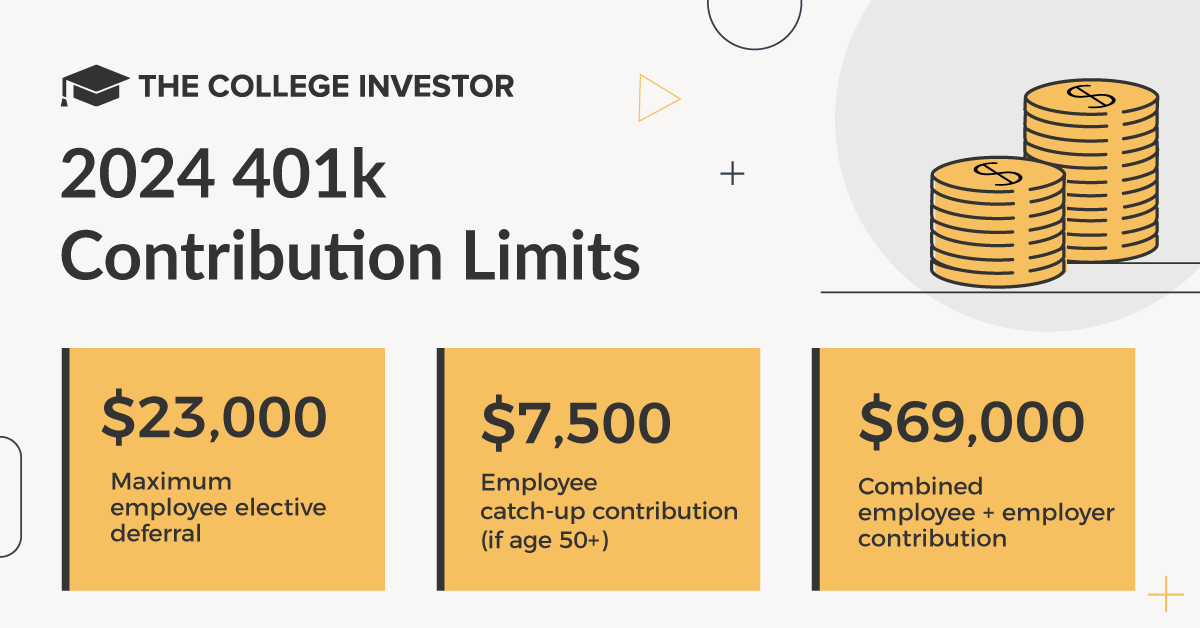

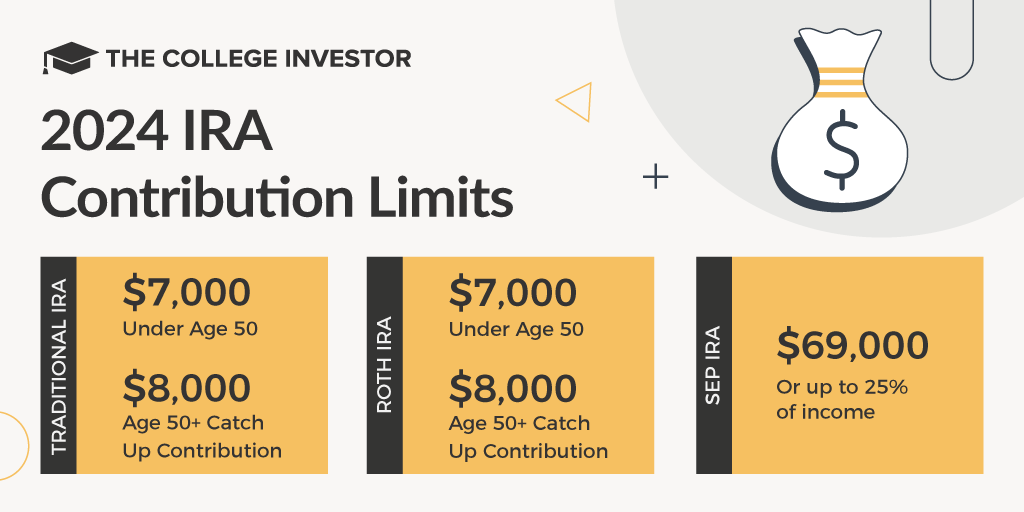

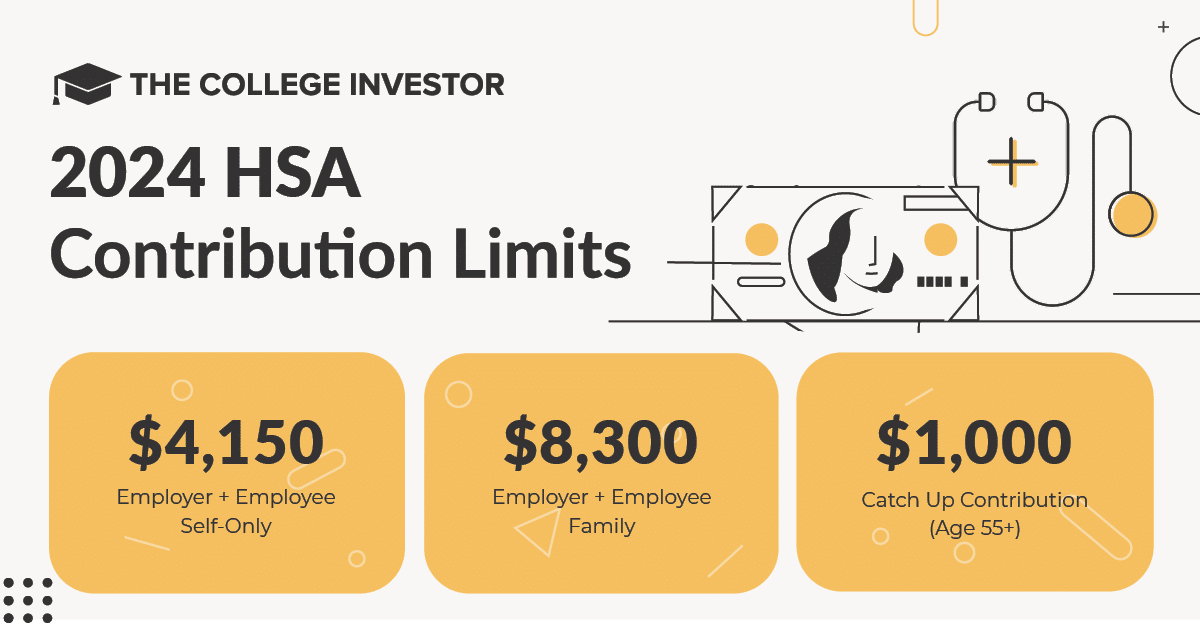

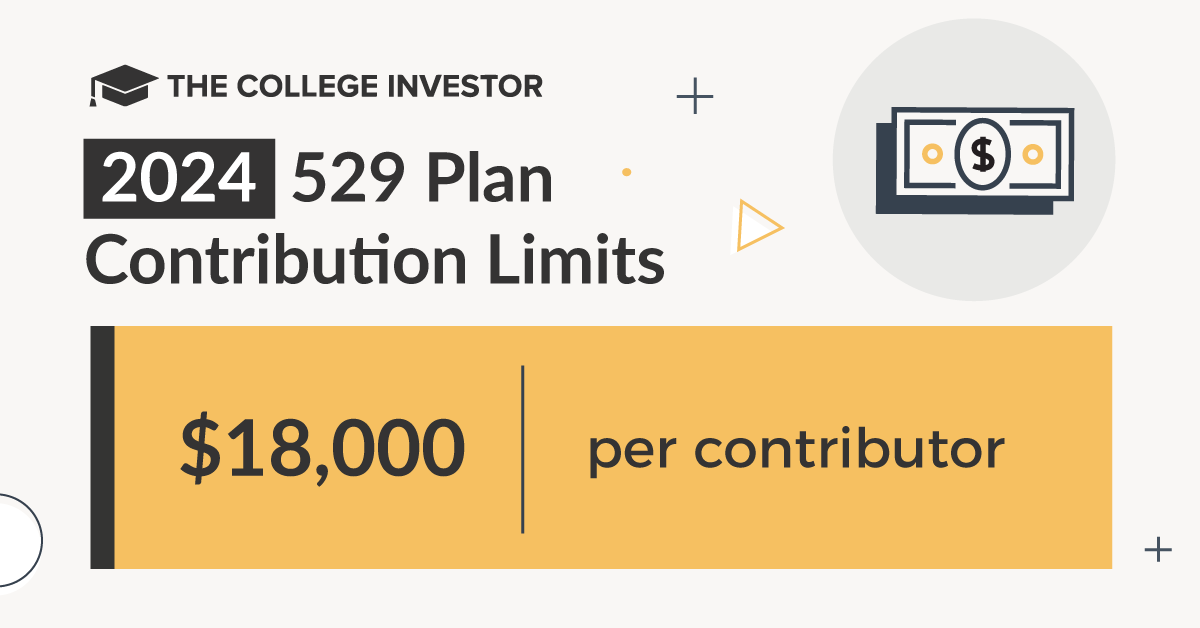

Contribution Limits

Tax deferred accounts have contribution limits that change every year. Here are the most common contribution limits:

Best Places To Invest

If you're looking for some great places to start investing, here's our round-up of the best stock brokers in 2024. Also, don't forget to check out the places that you can invest for free.

>> Bonus: Don't forget to check out the best brokerage promotion offers if you're planning to open a new account.

Brokerage Firm Reviews

Advanced Investing Strategies

There are a lot of advanced investing strategies and tools. Here are a few:

Cryptocurrency Investing

Cryptocurrency is a high-risk investment that has been gaining traction over the last few years. There are a lot of nuances when it comes to cryptocurrency, so here are our main guides:

Once you understand the basics of investing in cryptocurrency, check out these guides on what platforms to use:

Real Estate Investing

Real estate investing is another popular choice for investors. And over the last decade, technology has made real estate investing easier than ever. There are now tools and platforms that make real estate investing much more accessible to everyday people.

Here are some of the main real estate investing platforms:

The Best Tools For Investors (For DIY and Pros)

If you're an investor, it's essential that you have the right tools. Here's our guides to getting started investing by using some of our favorite tools and services (many of which are free):

Tax Topics

Taxes are a big deal when it comes to investing. Here's what you need to know on some of the most common tax questions we get asked.

Want to learn more about taxes - including reviews, resources, and tips? Check out our Tax Help Center for details.

More Articles On Investing

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]

Investing Terms And Definitions

Learn more about what these investing terms mean, from A to Z:

#

A

- Alpha

- Alternative Investments

- Annual Report

- Arbitrage

- Asset Allocation

- Asset Class

- Asset Management

B

- Backdoor Roth IRA

- Bear Market

- Beta

- Blue Chip Stock

- Boglehead

- Bond

- Bond Yield

- Book Value

- Bull Market

C

- Call Option

- Capital Gain

- Clearinghouse

- Collectible

- Commodity

- Compound Interest

- Consumer Discretionary Stock

- Consumer Price Index (CPI)

- Custodial Accounts

- Crowdfunding

- Cryptocurrency

D

- Day Trading

- Deflation

- Derivative

- Diversification

- Dividend

- Dividend Aristocrat

- Dividend Growth Investing

- Dollar Cost Averaging

- Donor Advised Fund (DAF)

- Dow Jones Industrial Average

E

- Earnings-Per-Share (EPS)

- Earnings Report

- Education Savings Account

- Emerging Markets

- Employee Stock Purchase Plan (ESPP)

- Equal Weighted Index Fund

- Equity

- Estate Planning

- Exchange Traded Fund (ETF)

- Expense Ratio

F

- Financial Advisor

- Financial Statements

- Fixed Income

- Floating Rate Fund

- Forex

- Fractional Shares

- Futures

G

H

- Halal Investing

- Health Savings Account (HSA)

- Hedge Fund

I

- I Bond

- Index Fund

- Individual Retirement Account (IRA)

- Inflation

- Initial Public Offering (IPO)

- Insider Trading

- Institutional Investor

- Interest Rate

J

- Junk Bond

L

- Large-Cap Stocks

- Leverage

- Liquidity

M

- Margin

- Market Capitalization

- Market Index

- Market Volatility

- Mega Backdoor Roth IRA

- Merger

- Mutual Fund

N

- NASDAQ

- Net Asset Value (NAV)

- Non-Fungible Token (NFT)

O

- Options

- Options Trading

- Order Routing

P

- Paper Trading

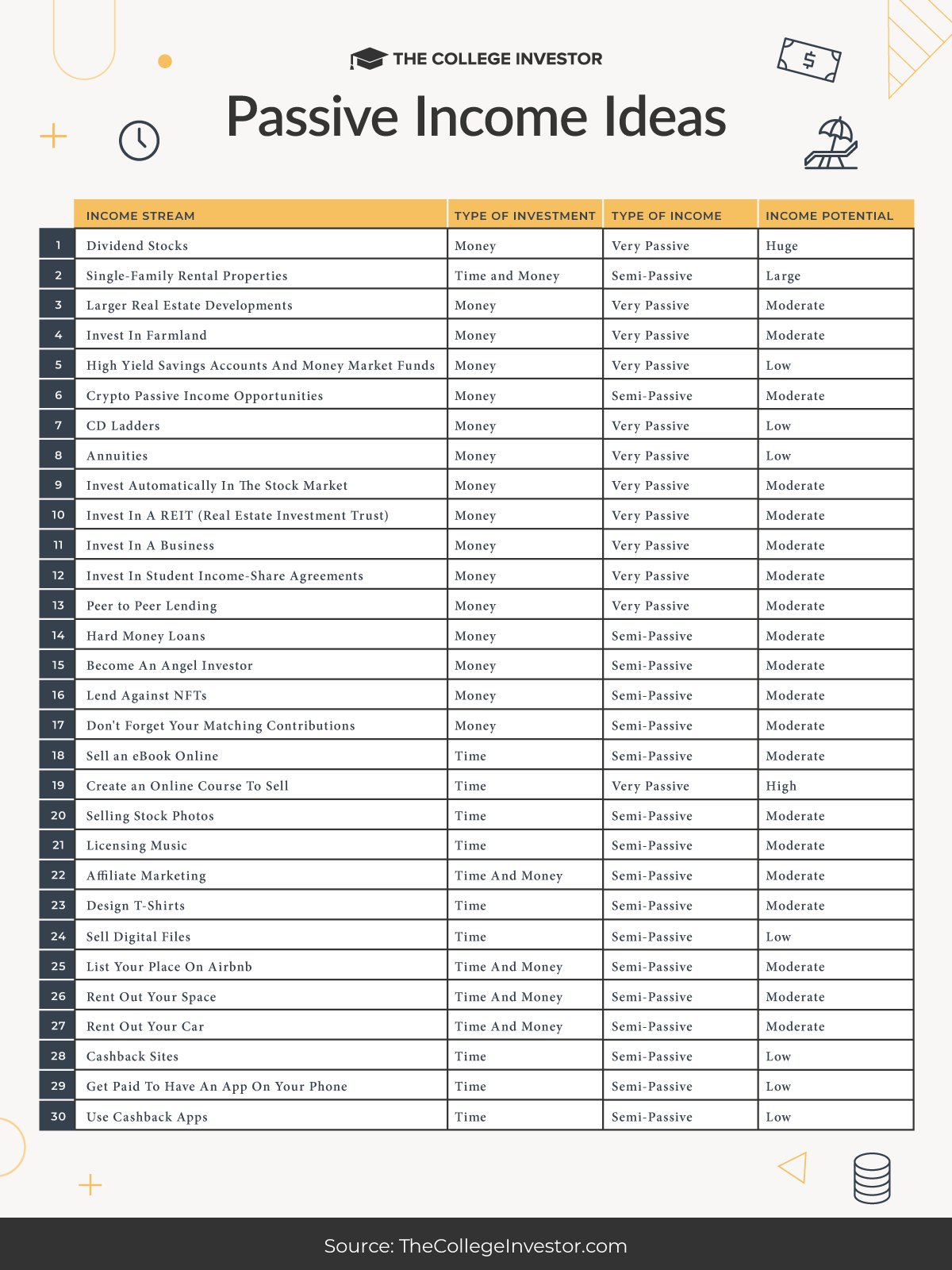

- Passive Income

- PE Ratio

- Penny Stock

- Pledged Asset Line of Credit

- Portfolio

- Preferred Stock

- Private Equity

- Put Option

Q

- Quantitative Easing

R

- Real Estate

- Real Estate Investment Trust (REIT)

- Return on Investment (ROI)

- Rebalancing

- Risk Management

- Risk Tolerance

- Robo-Advisor

- Roth

S

- S&P 500

- Savings Bond

- Securities

- Securities and Exchange Commission (SEC)

- Sector

- Self-Directed IRA

- SEP IRA

- Short Selling

- Silver

- Small-Cap Stocks

- Socially Responsible Investing (SRI)

- SPAC

- Stock Exchange

- Stock Market

- Stock Research

- Stock Split

- Strike Price

- Swing Trading

T

- Target Date Fund

- Tax Loss Harvesting

- Technical Analysis

- Trading

- Treasury Bonds

- Treasury Inflation-Protected Securities (TIPS)

V

- Value Investing

- Venture Capital

- Volatility Index (VIX)

W

- Warrants

- Warren Buffet

- Wash Sale

- Wealth Management

Y

- Yield Curve

- Yield-To-Maturity (YTM)

Editor: Ashley Barnett Reviewed by: Colin Graves