Liberty Tax Online is a brick-and-mortar tax preparation service with a white-labeled online tax filing tool. Its online presence is powered by Drake Software, which owns and operates 1040.com.

For 2024, filers interested in Liberty Tax have two methods to get their taxes done. A Liberty Tax tax professional can file taxes on your behalf or use the company’s online tool to file. This review focuses on Liberty Tax's online filing software. But we don’t recommend Liberty Tax for the typical tax filer.

See how it compares to the other best tax software options this year.

Liberty Tax Online Details | |

|---|---|

Product Name | Liberty Tax Online |

Federal Price | Starts at $45.95 |

State Price | $36.95 per state |

Preparation Type | Self-prepared |

Promotions | None |

Liberty Tax Online - Is It Ever Free?

No, Liberty Tax Online doesn’t offer a free filing option. All users pay for both state and federal filing. But you can “start filing free” to get a feel for the software and not pay until you file.

For basic returns, online pricing starts at $45.95 plus $36.95 per state for the basic tier. The Premium version costs $85.95.

What's New For 2024?

Liberty Tax software looks and feels similar to previous years. As with all competitors, you’ll see updates for new tax laws and changes. These include updated tax brackets and new limits for credits and deductions.

If you want the convenience of filing online while having the hard work done by a human in a Liberty Tax office, you can use the File Your Taxes Remotely program. However, we’re primarily focused on the DIY tax software option in this Liberty Tax 2024 review.

Does Liberty Tax Online Make Tax Filing Easy In 2024?

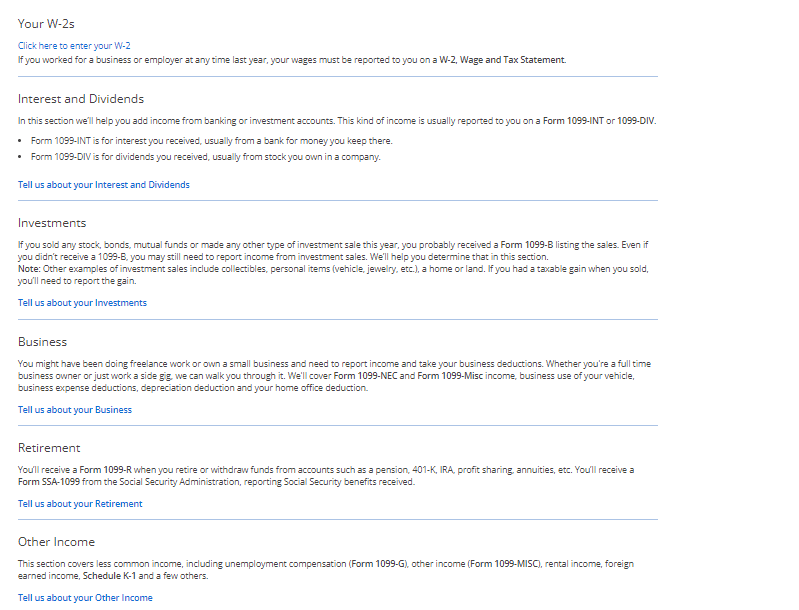

Liberty Tax online offers a decent user experience for many filers with simple tax needs, such as a W-2 and interest income. However, you can’t import forms into the software, which means you must manually enter your tax data. The software makes it easy to claim the most common deductions and credits.

Issues start to crop up for filers with more complex tax situations. For rental properties, including depreciation, it requires looking up a depreciation form and filling it out without much feedback. Users don’t even learn the total amount of depreciation ultimately calculated.

Investors with active stock or cryptocurrency accounts will find the software cumbersome. Because you can’t import 1099 forms or data spreadsheets, every transaction must be added manually. That’s a time-consuming and error-prone process.

It’s worth noting that many companies, including 1040.com and Jackson Hewitt Online, use the same software as Liberty Tax Online. It's a white-labeled version of software offered by Drake Software.

Liberty Tax Online Features

Liberty Tax Online has a few standout features. One cool offering is a “hybrid navigation model" where you can decide between question-and-answer style navigation or self-guided tax prep.

The interview questions help you access the right part of the software without getting bogged down in confusing menus. This is a useful navigation style for most people with straightforward returns.

Support from tax experts is another area where Liberty Tax stands out from the pack. It no longer offers its "Double Check Guarantee," but it still advertises that online filers can access in-person support from tax pros from any of its more than 3,000 local offices. Liberty Tax also has a "Virtual Tax Pro" option which lets you do your taxes yourself with the guidance of a Liberty Tax expert.

Liberty Tax Online Drawbacks

Liberty Tax Online had several big drawbacks in 2024.

No Form Import Options

The best premium tax software allows you to import W-2 and 1099 forms. Liberty Tax Online charges premium prices but doesn’t support imports other than completed prior-year tax returns for comparison.

Cumbersome For Complex Tax Situations

Filers with rental income or investment trades will want to stay away from this software. While Liberty Tax Online technically supports these tax situations, users must seek out calculators and forms by searching in the help section.

No Section Summaries

Section summaries allow users to track their progress and ensure they haven’t missed anything. Unfortunately, Liberty Tax Online software doesn’t have this, which makes it tough for filers to figure out whether they’re doing everything correctly until the end. This is a big disadvantage that leaves filers scrambling to figure out where they made a typo or mistake.

Liberty Tax Plans And Pricing

Liberty Tax moved to a tiered pricing structure with three plans to choose from: Basic, Deluxe, and Premium. Normally, each tier is $10 more. Here are the current prices of all three plans:

Plan | Basic | Deluxe | Premium |

|---|---|---|---|

Best For: | W-2 Income, no children and no HSA contributions | Claiming deductions and credits, stock trades | All other tax situations |

Federal Price: | $45.95 | $65.95 | $85.95 |

State Price: | $36.95 per state | $36.95 per state | $36.95 per state |

Total: | $82.90 | $102.45 | $119.90 |

It should be noted that in prior years, Liberty Tax has offered a variety of promotions that have significantly discounted the price.

How Does Liberty Tax Compare?

We compared Liberty Tax Online to other bargain tax prep companies, including 1040.com which uses the same underlying software. The other competitors are TaxHawk and Cash App Taxes which both offer a superior experience compared with Liberty Tax Online.

Header |  |  |  | |

|---|---|---|---|---|

Rating | ||||

Unemployment Income (1099-G) | Basic | Free | Free | Included |

Student Loan Interest | Deluxe | Free | Free | Included |

Import Last Year's Taxes | Basic | Free | Free | Included |

Snap a Picture of W-2 | Not Supported | Not Supported | Not Supported | Not Supported |

Multiple States | Basic | Not Supported | $14.99 Per State | Included |

Multiple W2s | Basic | Free | Free | Included |

Earned Income Tax Credit | Basic | Free | Free | Included |

Child Tax Credit | Deluxe | Free | Free | Included |

HSAs | Deluxe | Free | Free | Included |

Retirement Contributions | Deluxe | Free | Free | Included |

Retirement Income (SS, Pension, etc.) | Deluxe | Free | Free | Included |

Interest Income | Deluxe | Free | Free | Included |

Itemize | Deluxe | Free | Free | Included |

Dividend Income | Deluxe | Free | Free | Included |

Capital Gains | Deluxe | Free | Free | Included |

Rental Income | Deluxe | Free | Free | Included |

Self-Employment Income | Premium | Free | Free | Included |

Small Business Owner (Over $5k In Expenses) | Premium | Free | Free | Included |

Audit Support | Basic | Free | Deluxe | $29.95 Add-On |

Advice From | Available | Not Available | Available With The "Pro Support" Plan | Not Available |

First Tier Cost | Basic | Free $0 Fed & | Free | $25 |

Second Tier Cost | Deluxe | N/A | Deluxe | N/A |

Third Tier Cost | Deluxe | N/A | Pro Support | N/A |

Cell |

How Do I Get Support From Liberty Tax Online?

LibertyTax relies on a “360-degree” support model. Users can use the software’s “Tell Me More” buttons to learn more about tax topics, email libertyonlinesupport@libtax.com, or live chat.

You can also visit one of their 3,000+ local offices to get questions answered. Or if you get stuck and can't finish online, you can seamlessly transition from online filing to in-person filing with a tax pro.

Finally, LibertyTax comes with Audit Assistance for all users. That means a LibertyTax professional will help you respond to IRS inquiries if facing an audit.

Is It Safe And Secure?

Liberty Tax Online allows users to enable multi-factor authentication and encrypts all data entered into the software. Overall, the software meets industry standards for safety and security.

Of course, no company can guarantee 100% safety and security of its website. The company could suffer a security breach. Filers must evaluate the risks of using any online software before committing to a provider. Make sure to use unique, secure passwords on every website to keep the bad guys out of your data.

Why You Should Trust Us

At The College Investor, our approach is rooted in impartiality and informed by extensive experience. With over ten years of evaluating tax filing software and hands-on usage of numerous platforms in recent years, we have significant experience dealing with tax software.

Our goal is to assist you in finding the ideal tax application that aligns with your budget and specific requirements. We understand that tax filing is not one-size-fits-all, and we're committed to guiding you toward the most suitable solution tailored to your individual circumstances.

Liberty Tax FAQs

Here are the answers to some of the questions that we get asked most frequently about online tax software companies like Liberty Tax Online:

Can Liberty Tax Online help me file my crypto investments?

Users can enter their crypto trades using Liberty Tax Online, but the process is cumbersome. Each trade has to be individually entered on a screen before the next trade can be added. Most crypto traders should consider TurboTax Premium for their filing needs.

Can Liberty Tax Online help me with state filing in multiple states?

Yes, Liberty Tax Online supports multi-state filing. Users must pay $36.95 per state.

Does Liberty Tax Online offer refund advance loans?

Liberty Tax Online users in several states can apply for a refund advance loan. But filers should steer clear of these loans as they have effective interest rates as high as 199% APR.

Is It Worth It?

In 2024, Liberty Tax has high prices and offers little in return. Rather than going with this option, filers should check out the best tax software for their situation. Filers should also stay away from Liberty Tax’s loans which have sky-high interest rates.

Liberty Tax Online Features

Federal Cost | Starts at $45.95 |

State Cost | $36.95 per state |

Pay With Tax Refund | Yes, an additional fee will apply |

Audit Support | Yes, included on all tiers |

Support From Tax Pros | Available in person |

Full Service Tax Filing | Available in person |

Printable Tax Return | Yes |

Import Tax Return From Other Providers | Yes |

Import Prior-Year Return For Returning Customers | Yes |

Import W-2 With A Picture | No |

Stock Brokerage Integrations | None |

Crypto Exchange Integrations | None |

Self-Employment Income | Yes |

Itemize Deductions | Yes |

Deduct Charitable Donations | Yes |

Refund Anticipation Loans | Yes, loan amounts range from $500 to $6,250 |

Customer Service Options | Email, Live Chat, In-Person Support |

Customer Service Email | libertyonlinesupport@libtax.com |

Web/Desktop Software | Yes |

Mobile Apps | iOS and Android |

Promotions | None |

Liberty Tax Online Review

-

Navigation

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Pricing

Overall

Summary

Liberty Tax Online’s tax software is effective and comes with multiple levels of support. However, there may be more user-friendly options.

Pros

- Guided interface works well for simple filing situations

- Filers can work with a Virtual Tax Pro

- Easy to transition to in-person filing

Cons

- Difficult to accurately enter trades and rental income

- No section summaries

- High prices for mid-tier features

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Ashley Barnett Reviewed by: Robert Farrington