Want to learn how to invest in stocks but don’t know where to start? Maybe you've done a few steps but don't know how to actually "invest" or buy your first stock. You’re not alone.

Many people have a general idea that investing in stocks would be a smart decision for their financial future. Yet the dreaded learning curve keeps a lot of would-be investors on the sidelines.

But stock market investing doesn’t need to be overly complicated and overwhelming. In this guide, you’ll get step-by-step instructions about how to invest in stocks for the first time. We’ll cover everything from choosing a broker and account type to picking your actual stock investments.

As you gain experience, you can always add new strategies and techniques to your stock market investing tool belt. But, in the meantime, here are a few easy ways to start investing in stocks today.

Create A Gap Between Your Income And Expenses

If you want to start investing in stocks, you need to have some discretionary income ready to invest. That means you need a gap between your income and expenses. Without a gap, you’ll be teetering on the edge of financial stability. And may end up cashing out your investments to pay for necessary expenses or debt.

To increase the gap, you’ll either need to increase your income or decrease your expenses. Experts can disagree on whether to focus on the income or expense side of the equation. But doing a little of both may be the fastest way to create financial margin.

Personally, I’ve had the most luck with containing most expenses (with the exception of childcare related expenses), and focusing on growing my income. But others find that cutting expenses is the fastest way to increase the gap. Whether you’re more focused on income or expenses, it’s valuable to keep an eye on expenses using an app like Monarch Money, YNAB or Empower.

Goals To Accomplish Before You Start Investing

Once you’ve created a gap between your income and expenses, there may be a few more financial goals to accomplish before you start investing. Here are a few things to consider crossing off your list.

Decide Why You’re Investing In Stocks

Most people who invest in stocks are interested in a sustainable path to building wealth. Typically, at least one of their major financial goals is ten or more years away and they are content to slowly build towards that goal.

Some good reasons to invest in stocks include:

- You want to retire in a decade (or more).

- You want to help your children pay for college starting in five or ten years.

- You want to become financially independent.

- You want to prudently grow money from a windfall (such as an inheritance, the sale of a home, the sale of a business, etc.)

Some bad reasons to invest in stocks include:

- You think you can pick the next Google.

- You think day trading reminds you of video games.

- You need to make a lot of money quickly.

Why are these bad reasons to invest in stocks? Because, honestly, it's unlikely that you’ll pick the next Google. And while some people make money through day trading, many people lose money.

Finally, stock market returns range from 7-10% over long periods of time. But the market has often lost money over short periods. You can check out this chart to see the stock market's full history of bull and bear markets. So if you want to learn how to invest in stocks successfully, a long-term perspective will be important.

I don’t say these things to discourage you from learning and experimenting on your investment journey. You could be the person who picks the next Google. Or you may be the next stock market wizard. But, most likely, your returns will be closer to the average. So it's good to set that as an expectation up front.

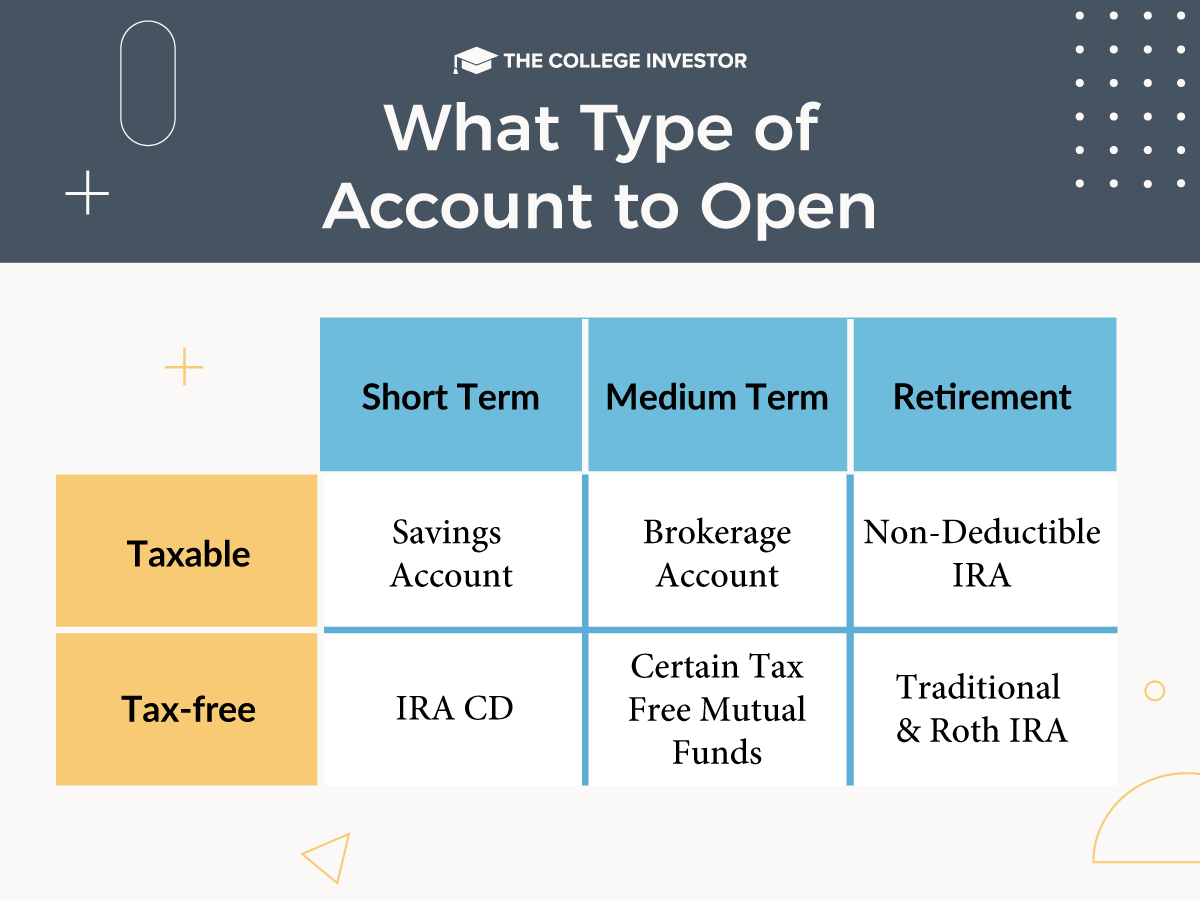

Select A Type Of An Investment Account

Once you’ve decided why you’re investing, you're ready to learn how to invest in stocks. Your first step will be to open an investment account.

Below we outline the major account types and their general limits and pros and cons. That said, if you’re a beginner with hundreds of thousands or millions of dollars, consult with a fiduciary financial advisor who can help you with your investment strategy.

Retirement Accounts

Retirement accounts are investment accounts that come with tax advantages. They also come with creditor protection (in some states), so they're a very low-risk way to build wealth.

The only drawback to using retirement accounts is that the money is somewhat locked up. If you withdraw money before age 59 ½ , you may face a 10% early withdrawal penalty.

That means you have to be careful before you decide to invest in these accounts. Some of the common retirement accounts include the following:

Employer-Sponsored Retirement Accounts

Employer sponsored retirement accounts include a 401(k), a 403(b), or the government TSP. Often your employer will provide a “match” on the funds you invest.

For example, if you invest 6% of your salary, your employer may offer a 3% match on top of that. If your employer offers a match on your 401(k), this is essentially free money. So you'll want to take full advantage of this benefit by making whatever contributions are necessary to max out your available match.

All of these accounts allow you to make pre-tax contributions. That means you won't pay taxes on the funds going into the account. But you will have to pay taxes on your withdrawals in retirement. If you withdraw funds before age 59 ½, you’ll pay a 10% early withdrawal penalty on top of the income taxes you have to pay.

The maximum you can set aside in these accounts is $22,500 per account type per year for 2023. If you're over age 56, you can put in an additional $7,500 per year. Some employer-sponsored plans also offer a “Roth” version of the plan.

See the 401k Contribution Limits here.

Roth IRA

A Roth IRA is an individual retirement account. You’ll pay income taxes on the money you put into the account. But once it's in the account, it grows tax-free and you won't pay taxes on your withdrawals in retirement either.

Even better, you can withdraw contributions (but not earnings) to this account penalty-free at any point. The maximum you can set in these accounts is $6,500 per person per year. You can contribute up to $1,000 additional dollars to the account if your over age 56.

Once you open up a Roth IRA, you can invest in just about anything you want including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and even options in some cases.

There are income limits on the Roth IRA. You can contribute the full amount if you earn less than $138,000 as a single person or $228,000 if you are married filing jointly.

You can have both a Roth IRA and an employer sponsored retirement plan. Once you contribute up to the match in your employer sponsored plan, it makes sense to start maxing out your Roth IRA.

Traditional IRA

A traditional IRA is a pre-tax retirement account for people who don’t have access to employer-sponsored retirement accounts.

Similar to a 401(k) plan, your Traditional IRA contributions are tax-deductible in the year you make them. Traditional IRAs also grow tax-free. But you will pay tax on your distributions in retirement.

As with Roth accounts, the maximum you can set aside in a Traditional IRA is $6,500 per person per year. But you can contribute $7,0=500 if you’re over age 56.

See the IRA contribution limits here.

Self-Employed Retirement Accounts

If you’re self-employed, you may want to consider a Solo 401(k), a SEP-IRA or a Simple IRA. These are basically workplace retirement accounts for sole-proprietors, independent contractors, or small business owners. Here are the pros and cons of each plan.

Taxable Brokerage Accounts

If you’re not investing for retirement, or you don’t want your money locked up, you may be interested in a standard brokerage account. With these accounts, you can withdraw your funds at any time. But, on the downside, these accounts don’t come with any tax advantages.

Depending on your broker, you may be able to automatically invest money in your standard account by setting up a basic routine. Or you can allow a robo-advisor to do the investing for you. Robo-advisors select investments and rebalance the portfolio regularly. For completely hands-off investing, this may be your best option.

Open An Investment Account And Fund It

Once you’ve decided the type of account to open, you need to open the account. For employer-sponsored retirement accounts, talk to your HR representative.

For all other accounts, these are our picks for top brokerages.

After you open the account, you should be able to electronically transfer funds to the account. Once you send the money you should see that the money is available as “cash” or some similar investment. Once you see the money in your account, you can get started investing!

Choose Your First Investment

When it comes to investing in stocks there are thousands of options in the United States alone. Once you look to international borders, the number increases to tens of thousands. On top of that, there are funds which invest in baskets of stocks.

With so many options, what should you choose? The most important piece of advice that I’ll offer is to avoid analysis paralysis. If you invest in anything, you’ll typically be better off than if you invest in nothing.

A common recommendation is that first-time investors should stick to investing in index funds. These are funds that mimic a stock market index such as the S&P 500 (which is a basket of the 500 largest stocks in the United States). Most major brokerages offer mutual funds or exchange traded funds are meant to mimic core indexes.

These are some of the core indexes to consider in your portfolio:

Index | Stocks This Index Tracks |

|---|---|

S&P 500 | Tracks the 500 largest stocks in the United States. It is weighted by the size of the companies (in terms of value of the stocks). |

S&P Mid-Cap | Tracks the performance of 400 mid-sized companies in the United States It is weighted by the size of the companies (in terms of value of the stocks). |

S&P Small Cap | Tracks the performance of 600 small companies in the United States. It is weighted by the size of the companies (in terms of value of the stocks). |

S&P Total US Stock Market | Tracks the performance of all publicly traded companies in the United States. |

MSCI Emerging Markets | Tracks the stock market performance of:

|

MSCI Developed Markets | Tracks the stock market performance of:

|

To invest, you’ll need to find the ticker symbol for the desired index fund. Then simply buy it through your broker.

Related: What is a clearing house and how does it actually work when you click buy a stock?

How To Place Your First Trade

One of the biggest questions we get on social media is "I've opened my account and funded it, now what?" Well, you have to actually place your trade! It's not enough to simply open your IRA or brokerage account. You need to put that cash to work.

It sounds scary, but it's actually pretty easy to place your first trade.

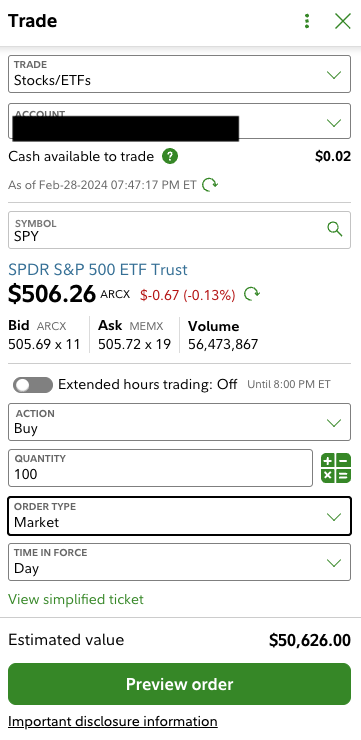

Step 1: Find the symbol of what you want to invest in (in our example, SPY for the S&P 500).

Step 2: Select Buy.

Step 3: Quantity of Shares. You typically buy investments in either "dollars" or "shares". If you don't know how many shares, you can click that calculator and it will figure out how many shares based on your dollar amount.

Step 4: Select market or limit order. Market order means that the trade will happen immediately, no matter the price. Limit orders have a price, and it won't execute the trade until the price is at that limit. For long term buy-and-hold investors, market orders are usually fine. Traders rely on limit orders.

Step 5: Hit preview order, and then approve.

Here what this looks like at Fidelity:

Automate Your Investments

Getting your first investment is an amazing accomplishment. But if you want to really grow your wealth, you'll need to continue investing over time. I recommend automatically investing a portion of your income each paycheck or each month.

Most investment platforms make this very easy to do. Once you start this process, you’ll probably find that you don’t miss the money that you’re investing. Ideally, as you grow your income, you can make a point to invest more automatically.

Final Thoughts

Don't let fear keep you from getting started with stock market investing. Even as a beginner, you can quickly and easily build a diversified portfolio that matches your risk tolerance by using index funds or a robo-advisor.

With so many free investing apps available today, it's also never been a more affordable time to invest in stocks. Here are the best investing apps to trade for free.

Finally, the more you learn about how to invest in stocks, the more confident you'll become. For more investing tips, check out our full guide to investing.

Want to learn more? Check out these articles:

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller