Streitwise is a private real estate investment company.

Getting your asset allocation right is one of the keys to successful long-term investing. But when you’re just getting started, certain asset classes tend to be neglected in a typical investment portfolio. In particular, many people with otherwise solid investment strategies completely neglect any type of real estate investment.

Some people justify their lack of real estate investments by saying that publicly traded companies own land and real estate. Others consider their personal residence an adequate real estate investment. But in many cases, real estate is simply overlooked.

If you’re not currently investing in real esate, or your primary investments in real estate are publicly traded REITs, you may want to consider adding a private REIT such as Streitwise to your portfolio.

Streitwise is a real-estate investment trust with low fees (relatively) and low investment minimums. It invests primarily in cash-flow (rental) real estate, so investors may see the benefit of cash flow throughout the life of the investment.

If you’re considering investing in real estate, but you don’t want to own a rental property, investing in Streitwise could be for you. Before you invest, here’s what you need to know.

Quick Summary

- Private REIT focused on cash-flowing real estate (typically office buildings)

- Open to both accredited and non-accredited investors

- Strong passive income through high dividend yields

Streitwise Details | |

|---|---|

Product Name | Steitwise |

Min Investment | $3,505 (500 shares) |

Annual Fee | 2% AUM |

Open To Non-Accredited Investors? | Yes |

Promotions | None |

Who Is Streitwise?

Streitwise is a REIT that manages real estate (mostly office properties). It was founded in 2016 and is sponsored by Tryperion Partners.

An REIT (or real-estate investment trust) is a company that owns and manages cash-flowing real estate. The REIT passes along profits to its shareholders in the form of a dividend.

“We want our real estate investments to change lives", says Streitwise co-founder Eliot Bencuya, "...One dividend at a time."

But Bencuya and his other two founding partners don't just talk about their belief in Streitwise. They put their money where their mouth is. The co-founders now have over $5 million of their own "skin-in-the-game."

What Does It Offer?

If you’re an accredited investor (income over $200,000, or $300,000 as a couple, or a million-dollar net worth outside of your primary house), you can freely invest in Streitwise.

If you’re not an accredited investor, you may still invest, but you face limits on your investment. Your total investment must be less than 10% of your net worth (excluding your home) or annual income.

If you live outside of the United States, you can contact Streitwise to learn about whether or not you qualify. The company has a process for approving international investors. Here's what you'll get if you decide to invest with them.

Strong Historical Returns (Even Through The Pandemic)

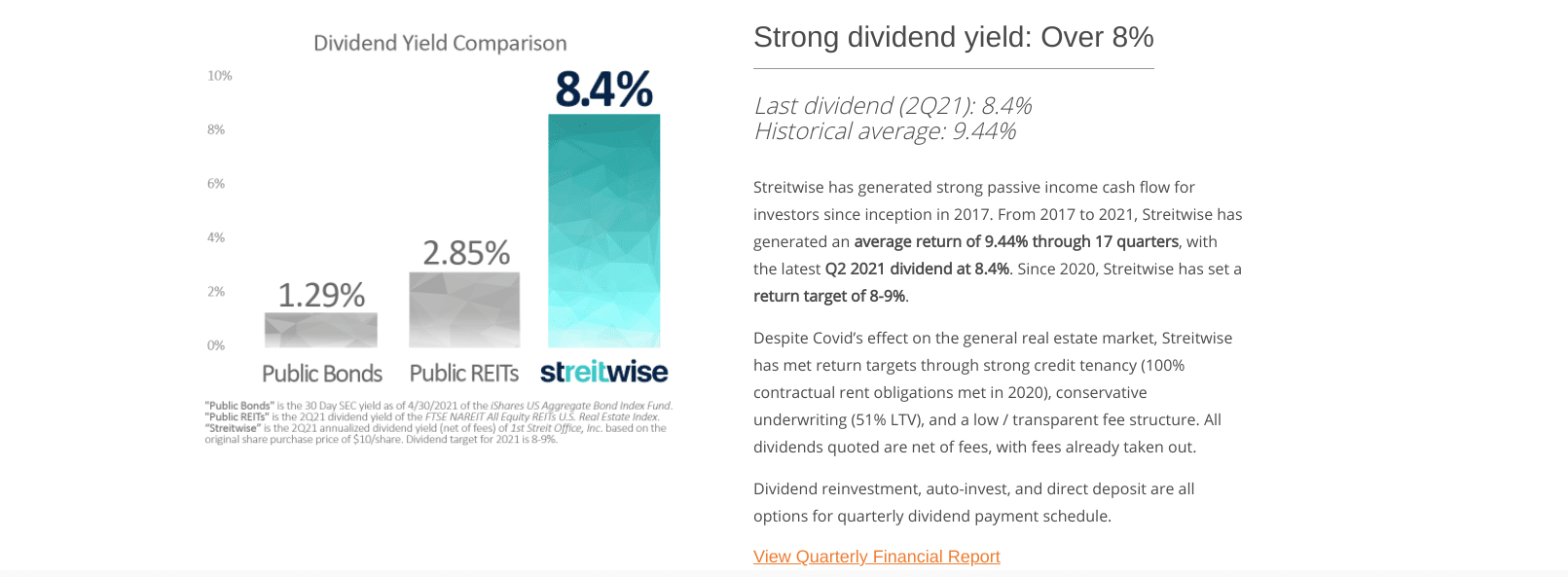

When we first reviewed Streitwise in 2019, they had already enjoyed a few years of strong performance. But that was before social distancing guidelines caused so many companies to send their employees home.

And if there's one type of real estate that would seem most vulnerable to a worldwide "work from home" shift, it would be commercial real estate. But the good news for investors is that Streitwise has continued to generate impressive returns throughout the recession.

It just paid out its latest quarterly dividend payout for Q4 2021 at $0.21/share. That equates to an annualized return of 8.4%. That means Streitwise has hit its target return range (8-9%) for 19 straight quarters. It also says that, as of January 2022, it has collected 100% of rent obligations from every tenant in its portfolio.

This is all great news. However, it's important to remind investors that historical performance is still never a guarantee of future returns.

Share Redemption Program

REITs are typically considered an illiquid type of investment. That means it’s tough to get your principal investment out except after a set period of time.

It's not unusual for some crowdfunding real estate sites to require holding periods of several years with no early redemption program. However, while Streetwise still isn't as liquid as stocks, it offers more liquidity than many other private REITs.

If you invest in Streitwise, your initial investment is locked up for at least one year. But after the lockout period, you can redeem shares on a quarterly basis. You will have to redeem your shares at a discount, though, until you've held your shares for at least five years.

This table shows how much your shares can be redeemed for, depending on when you make your redemption request:

Holding Period | Redemption Value |

|---|---|

1 Year | 90% of NAV |

2 Years | 92.5% of NAV |

3 Years | 95% of NAV |

4 Years | 97.5% of NAV |

5 Years | 100% o NAV |

Support For Some Retirement Accounts

If you choose to invest in Streitwise, you can invest in a self-directed IRA or a Solo 401(k). It says that it's an approved custodian with providers such as Millennial Trust Company, New Direction Trust Company, Advanta IRA, Equity Trust, Strata Trust Company, and more.

You can also invest in an individual or joint account. However, Streitwise doesn’t currently support traditional or Roth IRAs. Before opening any tax-advantaged account, you may want to speak to a tax professional or a financial advisor.

Are There Any Fees?

As far as investments go, REITs such as Streitwise have more structural risk than real-estate index funds or publicly traded stocks. They also come with higher fees. Streitwise is known as a low-fee REIT. It charges a 3% upfront investment fee plus a 2% annual management fee. These are fees you’ll be charged even if Streitwise fails to perform.

One thing that we like about Streitwise is that it has very transparent fees especially compared to other platforms. That 3% upfront may seem high. But when you look at other platforms, they may advertise a lower up-front fee, but then have many "hidden fees" within their funds or what sponsors charge.

How Does Streitwise Compare?

Streitwise is the latest of multiple online real estate investing firms that have emerged over the last few years. Where Streitwise differentiates itself is with transparency of fees - you know what you're going to pay on all ends of the deal.

See how Streitwise compares here:

Header |  | ||

|---|---|---|---|

Rating | |||

AUM Fees | 2.00% | 1% to 1.25% | 1.00% |

Min Investment | $3,505 | $5,000 | $500 |

Open To Non-Accredited Investors? | |||

Cell |

How Do I Open An Account?

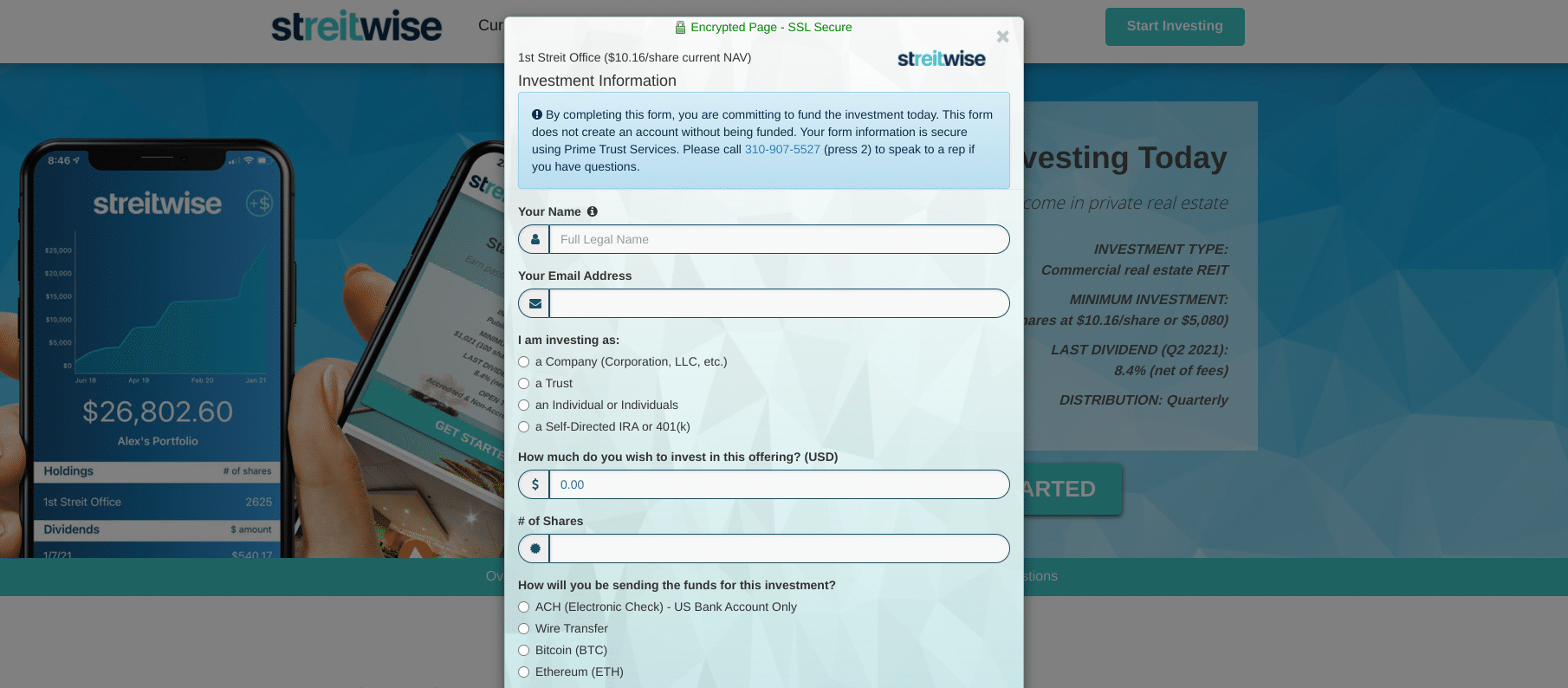

To get started with Streitwise, you can visit its website here. From the homepage, click the big "Start Investing" button.

Next, you'll fill out your personal information, choose your account type, and input how much you want to invest. You'll also be asked to select your funding type. In addition to bank transfers, you can now invest with cryptocurrency as well -- Bitcoin or Ethereum.

After you provide this initial information, you'll need to give more details about your annual income and net worth before linking your bank account. In our test, it only took about 5 minutes to complete the entire application.

Once you've registered with Streitwise, you can download its iOS app to manage your account on the go. Unfortunately, the company doesn't currently have an Android app.

Is It Safe And Secure?

The Streitwise website is encrypted with Transport Layer Security. However, unlike with some other platforms, you won't find a dedicated page on the site that discusses its data security measures in greater detail

When it comes to the money you invest, it's important to understand that it will not be protected by SIPC or FDIC insurance. In other words, if Streitwise was to go out of business, you could lose your entire investment.

Thankfully, Streitwise has a longer track record of success than some of its competitors. But with private REITS being more risky than more traditional investments like stock index funds and ETFs, you'll still want to avoid putting too many of your financial eggs in this one basket.

How Do I Contact Streitwise?

You can get in touch with Streitwise by calling 310-907-5527 or emailing them at invest@streitwise.com. You can also schedule a call with Streitwise at this page.

We struggled to find many customer reviews for Streitwise online. However, it does have an A+ rating with the Better Business Bureau (BBB) and it's recently-released iOS mobile app has a rating of 3.7/5 star-rating on the Apple App Store.

Is It Worth It?

Streitwise is an excellent privately traded REIT, but it's a risky investment. It’s important to understand how the REIT will fit into your overall investment strategy before putting money into it.

When it comes to a showdown between REITs and rental properties, it’s tough to say whether one is better than the other. REITs are completely passive and are more liquid than rental properties. However, an investment manager runs the investment, not you.

Rental properties tend to be a lot of work on the front end, and they have a higher potential return. However, you can also lose a lot of money with rental properties.

I would argue that most people should have real estate in their portfolio. But choosing between an REIT like Streitwise and a rental property is a personal decision.

Streitwise FAQs

Let's answer a few common questions about Streitwise:

Is Streitwise open to non-accredited investors?

Yes, but non-accredited investors can't invest more than 10% of their net worth or annual income, whichever is greater.

Are REITs tax-efficient?

Yes, investors can take advantage of pass-through deductions of up to 20% of their REIT dividends. They also aren't subject to double taxation and tax liability can be further reduced through depreciation deductions.

What is the minimum investment with Streitwise?

Streitwise recently changed its minimum investment amount from 100 shares ($1,000) to 500 shares ($5,000).

Can you reinvest your Streitwise dividends?

Yes, Streitwise has an dividend reinvestment program that's easy to enroll in. However, for IRA accounts, a custodian representative must sign the enrollment forms.

Streitwise Features

Account Types |

|

Minimum Investment | $3,505 (500 shares) |

Fees |

|

Target IRR | 8% to 9% |

Open To Non-Accredited Investors | Yes |

Investment Options | One current offering: 1st Streit Office Inc

|

Fund Transparency | High -- fund financials are filed publicly with the SEC |

Investment Term | 1-5+ years |

Lock-Up Period | 1 Year |

Share Redemption Program | Yes, but shares cannot be redeemed before they've been held for one year and can't be redeemed fee-fee until they've been held at least five years |

Secondary Market | None |

Customer Service Phone Number | 310-907-5527 |

Customer Service Email Address | invest@streitwise.com |

Web/Desktop Access | Yes |

Mobile App Availability | iOS |

Promotions | None |

Streitwise Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Diversification and Risk Management

Overall

Summary

Streitwise is an online real estate investing platform that is open to both accredited and non-accredited investors and has enjoyed strong historical returns.

Pros

- Transparent fee structure

- Focus on cash-flowing real estate

- High historical dividend yields

- Open to non-accredited investors

Cons

- One-year lock-up period

- Shares that are redeemed within 5 years are discounted

- Some competitors have lower fees

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett