Schedule E is part of IRS Form 1040. It is used to report income or loss from rentals, royalties, S corps, partnerships, estates, trusts, and residential interest in REMICs (real estate mortgage investment conduits).

Schedule E is for “supplemental income and loss,” and not earned income. Earned income is income generated from business activities.

Supplemental income is considered passive income, such as collecting rent. Of course, as a landlord, you know that rental income is anything but passive. However, passive is how the IRS sees it.

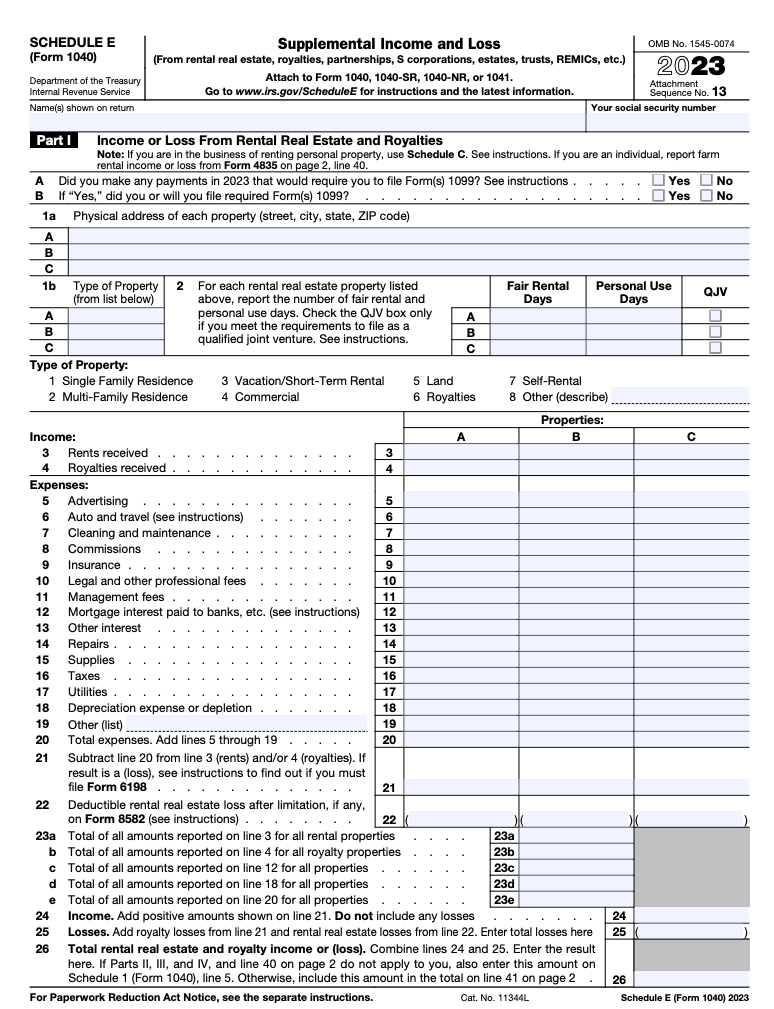

Schedule E Tax Form

Here's what the Schedule E looks like:

You can download the most up to date Schedule E from the IRS website here.

Rental Income

If you have rental income, Schedule E must be filled out.

Let’s say you purchase a house and rent it out. On Schedule E, “Type of Property” will be “1.” There are eight property types to choose from, and each has a corresponding number. Across from Type of Property is “Fair Rental Days.” These are the days that the property was rented out during the year.

Next is to list your income. If you had rental income of $1,200 per month or $14,400 for the year, you’d enter in $14,400 for “rents received.” If you have a multi-unit building, add all rental income from the building and enter it for that property type, which will be “2” for Multi-Family Residence.

Expenses are below the income line. Schedule E has several line items for expenses, which include:

- Advertising

- Auto and travel

- Cleaning and maintenance

- Commissions

- Insurance (does not include PMI)

- Legal and other professional fees

- Management fees (rental agencies and property management companies)

- Mortgage interest paid to banks

- Other interest

- Repairs

- Suppliers

- Taxes

- Utilities

- Depreciation expense or depletion

- Other

It’s likely that many of the above expenses will apply to the rental. If you leave any expense out, you’re paying taxes on non-existent income.

That’s why keeping excellent records about your rental property is important. This can be done in a spreadsheet or in accounting software designed for rentals. Having good records is not only a good business practice, but will help verify your Schedule E entries if the IRS has further questions about them.

If you don’t have good records and instead have to scramble to scrape together receipts when the IRS comes calling, you’ll likely end up presenting incomplete information. In that case, the IRS may impose additional taxes and penalties. If you keep security deposits after a tenant moves out, they are considered income.

If you did buy a house to rent out, depreciation could be taken on it. Depreciation is entered into Form 4562 (Depreciation and Amortization). Once depreciation for the year has been calculated, it can be entered into Schedule E for the depreciation line item.

Schedule E has enough room for three rental properties. If you have more than three rental properties, use multiple Schedule Es. Lines 23a–26 should be filled in for only one Schedule E by combining totals from your other Schedule Es.

Note that rentals of personal property such as a car or equipment is not included on Schedule E. They should go on Schedule C.

Unrelated to rental properties, any royalties received for oil, gas, or mineral properties (not including operating interests); copyrights; and patents go on line 4, just under rental income. Royalties of $10 or more are accompanied by a Form 1099-MISC.

If you provide substantial services to your tenants, such as house cleaning and food services, instead of filing Schedule E, you’ll file Schedule C for business profit and loss.

Parts III and IV of the Schedule E are for income or loss from estates and trusts, and REMICs, respectively.

Partnership or Shareholder in S Corp

Part II of the Schedule E is for income or loss from partnerships or S corps. Members of a partnership or S corp receive a Schedule K-1. Information on the Schedule K-1 is transferred to the Schedule E. The Schedule K-1 should not be attached with your Schedule E. It should be kept for your personal records.

Passive Activity Loss Limit

Passive loss limitations are based on your adjusted gross income (AGI). If it is less than $100,000, you can claim up to $25,000 of losses reported on line 26 of your Schedule E. If you make between $100,000 and $150,000, the loss amount starts phasing out. If you make over $150,000, the loss on line 26 cannot be claimed.

For those with an AGI over $150,000, not being able to claim your passive loss might sound like heresy. But before you write a letter to Congress in protest, the loss is not actually lost. It is reported on IRS Form 8582 and carried forward.

In summary, Schedule E is for income or losses that are not generated from business operations. Schedule E income is considered passive. The result of Schedule E eventually finds its way to line 17 of your IRS Form 1040. If it isn’t there, you may have run into the passive activity loss limit.

Filing Your Taxes

If you're a landlord, filing your taxes can be a bit confusing. But that doesn't mean you can't do this yourself. Most major tax software makes filing a Schedule E very simple - and if you use the same tax software from year to year, it will easily allow you to keep track of your depreciation and more.

Our recommendations for the Best Tax Software For Landlords can be found here >>

Sadly, landlords will pay for the premium versions of most tax software products, but that's still cheaper than using a professional tax preparer. However, a professional can be a good choice if you're overwhelmed by your taxes.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves Reviewed by: Ashley Barnett