The IRS requires Solo 401k plan owners with more than $250,000 in their plan to file a Form 5500-EZ every year. The form satisfies annual reporting and filing obligations set by the IRS.

It's another “to-do” for already busy self-employed people. Thankfully, the “EZ” in the form name indicates the difficulty of filing this form. Most Solo 401k plan holders will be able to fill out the form in under an hour each year.

This guide explains how to approach IRS Form 5500-EZ if you’re filing it for the first time. It clarifies some of the more confusing jargon found on the form. You'll also find information on when you may need to hire a third party to accurately fill out the form.

What Is IRS Form 5500-EZ?

IRS Form 5500-EZ exists to help Solo 401k plan owners (usually self-employed people) meet the regulatory requirements associated with retirement plans. The form must be filed every year, 7 months after the end of the company’s fiscal year.

Since most self-employed people run their fiscal years using the calendar year, that means that the forms typically must be filed by July 31st of the following year. A lot of the information on Form 5500-EZ is used to file taxes. So it may make sense to complete it around the same time that you complete your return. However, the deadline is technically different.

Again, for most business owners, the IRS Form 5500-EZ is due on July 31.

Not all Solo 401k plan owners have to file Form 5500-EZ. Only individuals with more than $250,000 in their plan have to file. Those who have more than one plan must file if they have more than $250,000 between all their self-employment retirement plans. And individuals who closed their Solo 401K must also file the form, regardless of the balance in the account.

If you're a spousal couple with two accounts in one Solo 401k plan, you must file Form 5500-EZ when the combined balance of both accounts exceeds $250,000. This applies for all sub-accounts of the Solo 401k.

What Information Do I Need To Fill Out IRS Form 5500-EZ?

IRS Form 5500-EZ has five distinct sections:

- Annual Return Identification Information

- Basic Plan Information

- Financial Information

- Plan Characteristics

- Compliance and Funding Questions

Below, we break down the information that is required in each area:

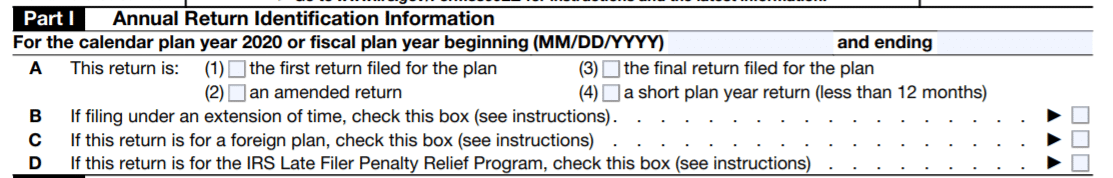

Annual Return Identification Information

The annual return identification information gives the IRS basic information about the filing. The first question here is one of the most important. Filers will need to indicate the following:

A1: Is this the first year filing for this plan?

A2: Is this filed as an amended return?

A3: Is this the last year a return will be filed for the plan (ie- you changed plans or stopped being self-employed)

A4: A year in which the plan had less than 12 months of filing.

It's important to note that you can check ANY or NONE of the boxes.

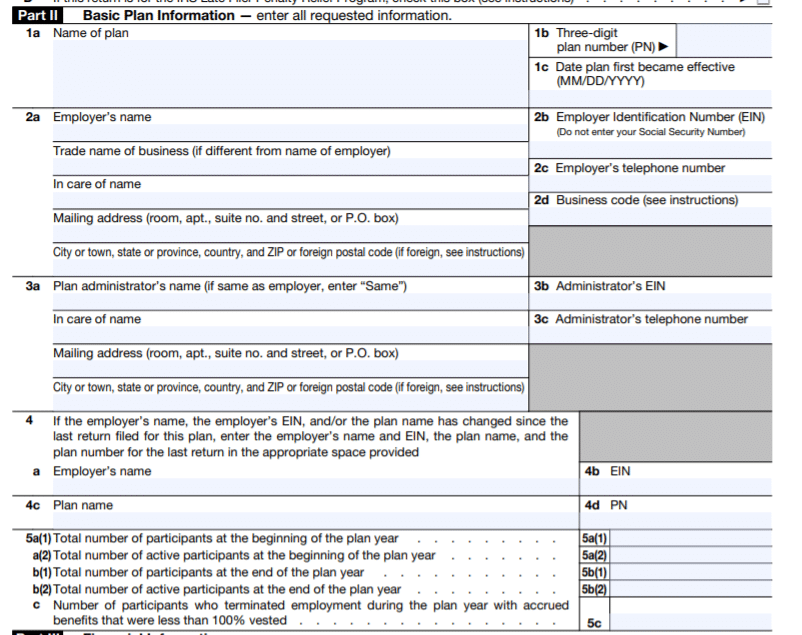

Plan Information

The next section provides information about the plan itself. If you host your Solo 401k at a discount brokerage, you can usually get all this information from your broker's online portal. If you have a self-directed Solo 401k, you may need to work with an account steward or your accountant to gather these details.

Note: In 2b, this is for your small business' EIN - NOT your Solo 401k Plan EIN.

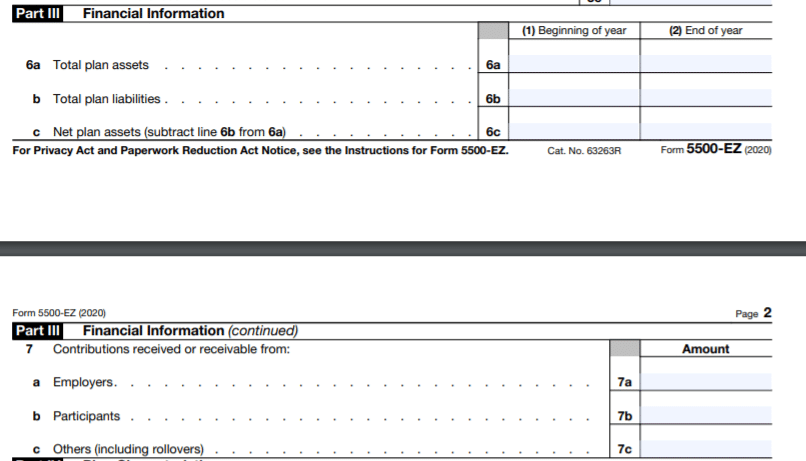

Plan Financials

The plan financials section is one of the most important aspects of Form 5500-EZ. Again, if you have your Solo 401k at a brokerage, it should provide you with all the information you need. This includes the amount of money you had at the beginning and end of each year, and whether the plan had liabilities.

You'll also need to disclose the contributions of three different groups. These are: Employers, Participants (that’s the “Employee” section), and Others (typically this will only include rollovers). Again, this information should be easy to find if you have a typical Solo 401k hosted at a brokerage.

For contributions, it's important to be consistent in how you report these contributions (and ideally, they should match the accounting structure of your business - cash or accrual). What this means is, if you made an employer profit sharing contribution to the plan, you'd need to report it either as cash or accrual.

Example:

If your business is a cash business, and you're filling out this form for 2022, you'd only report contributions made January 1, 2022 to December 31, 2022. If you made the contribution during the 2022 year, you'd report it here. If you made a contribution January 1, 2023 but before you filed your taxes, you would NOT report it. You'd report it the following year.

However, if your business is accrual reporting, you could report the profit sharing contribution.

In the end, what matters is consistency. So, if you report a cash basis on when you make the contribution, stick to that year after year.

Self-directed Solo 401k plans are more likely to have complications. If the self-directed account houses real estate or other tangible assets, plan holders may have to pay for a professional appraisal each year. Additionally, they will need to track any liabilities (such as mortgages) held by the plan.

A few other notes:

- Box 6a1, 6b1, and 6c1 - If this isn't your first year, Box 1 must match your prior year 5500-EZ. Double check!

- For contributions, the employer side is the profit sharing contribution, and the participant is your elective contribution. Remember the 401k contribution limits.

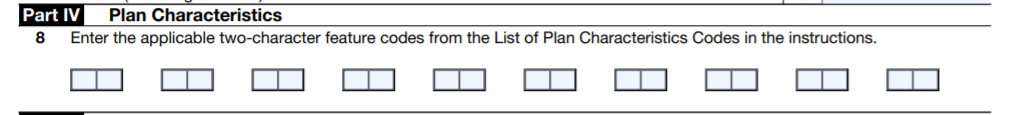

Plan Characteristics

Next, we look at the most opaque section of Form 5500-EZ. This is the section that requires filers to enter two-digit codes that specify plan characteristics.

The definitions of these two-digit codes are provided by the IRS. Unsurprisingly, that means they can be fairly confusing for a layperson.

However, the brokerage that hosts your plan should provide you with these codes each year when it sends your Form 5500 information. If you don’t receive Form 5500 information from a broker, you may need to work with an accountant or a representative that helped you set up the plan to determine the codes needed.

Codes applicable to the most Solo 401k plans:

2E – profit sharing

2J – section 401(k) feature

3B – plan covering self-employed individuals.

2R – participant-directed brokerage accounts

2S – plan provides for automatic enrollment in plan that has employee contributions deducted from payroll.

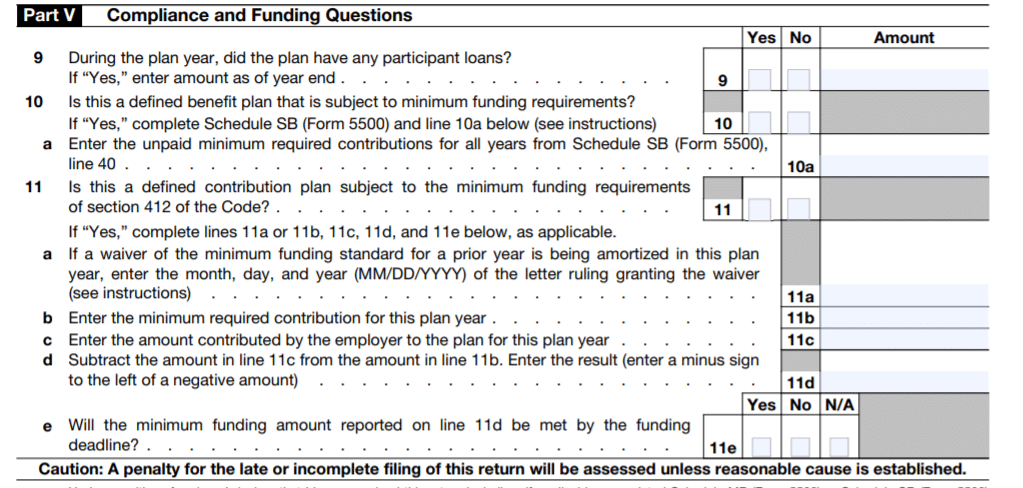

Compliance And Funding Questions

The final section covers important compliance information for the IRS. Question 9 asks whether participants (aka you or your spouse) had any participant loans against the plan. Section 10 and 11 both ask about minimum funding requirements and waivers to those requirements.

Most Solo 401k plans that we recommend will help self-employed people steer clear of these requirements. This means you'll be able to answer "No" to these questions. If you're subject to minimum funding requirements you will, unfortunately, have to complete Form 5500 to answer the questions.

How Can I File IRS Form 5500-EZ?

Historically, plan owners had to file their forms by printing off the form, signing, and mailing it to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0020

Plan owners can still do this today. However, the IRS announced an online filing platform called EFAST2. EFAST2 allows plan holders to create an online profile and submit the Form 5500 series (including Form 5500-EZ) using the online portal.

The EFAST2 portal looks like it was built in 2008. But most Solo 401K plan holders will be able to quickly and easily file their Form 5500-EZ using it.

Should I Hire Outside Filing Help?

The Form 5500-EZ should be simple enough for most people to complete without the help of a professional. However, you may choose to hire an accountant or bookkeeper to file on your behalf. Some accountants may bundle this filing requirement with annual tax preparation. Also, many of the self-directed solo 401k plans like MySolo401k will handle preparation of this form for you.

A more common reason to seek outside help is in regard to account valuations. If your account includes only stocks and bonds, you can easily figure out the value on your own. However, plans that hold real estate or other difficult-to-value assets may need to hire a professional to appraise the portfolio value each year.

A professional appraisal report will typically count as acceptable proof of valuation should the IRS choose to audit the report.

Final Thoughts

Form 5500-EZ is a regulatory requirement for self-employed people who have Solo 401k’s with more than $250,000 worth of assets. The forms must be filed 7 months after the close of the fiscal year (typically by the end of July). It also has to be filed the year you close your plan.

While the form may seem daunting at first, most of the information you need will come straight from the brokerage that hosts your plan. With online filing as an option, filing Form 5500-EZ should be easier than ever before.

Looking to open a new Solo 401k? Compare the most popular providers here >>>

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak