Filing your taxes can seem like a maze of dates and forms. Get one wrong, and you’ve wasted a lot of time and may have incurred late fees.

We’ve put a simple guide together to help you navigate the forms and their related due dates. The following dates are the tax dues dates in 2024.

The main tax deadline for personal taxes is Monday, April 15, 2024.

We also included the estimated tax deadlines for 2024, since making estimated tax payments can always be annoying.

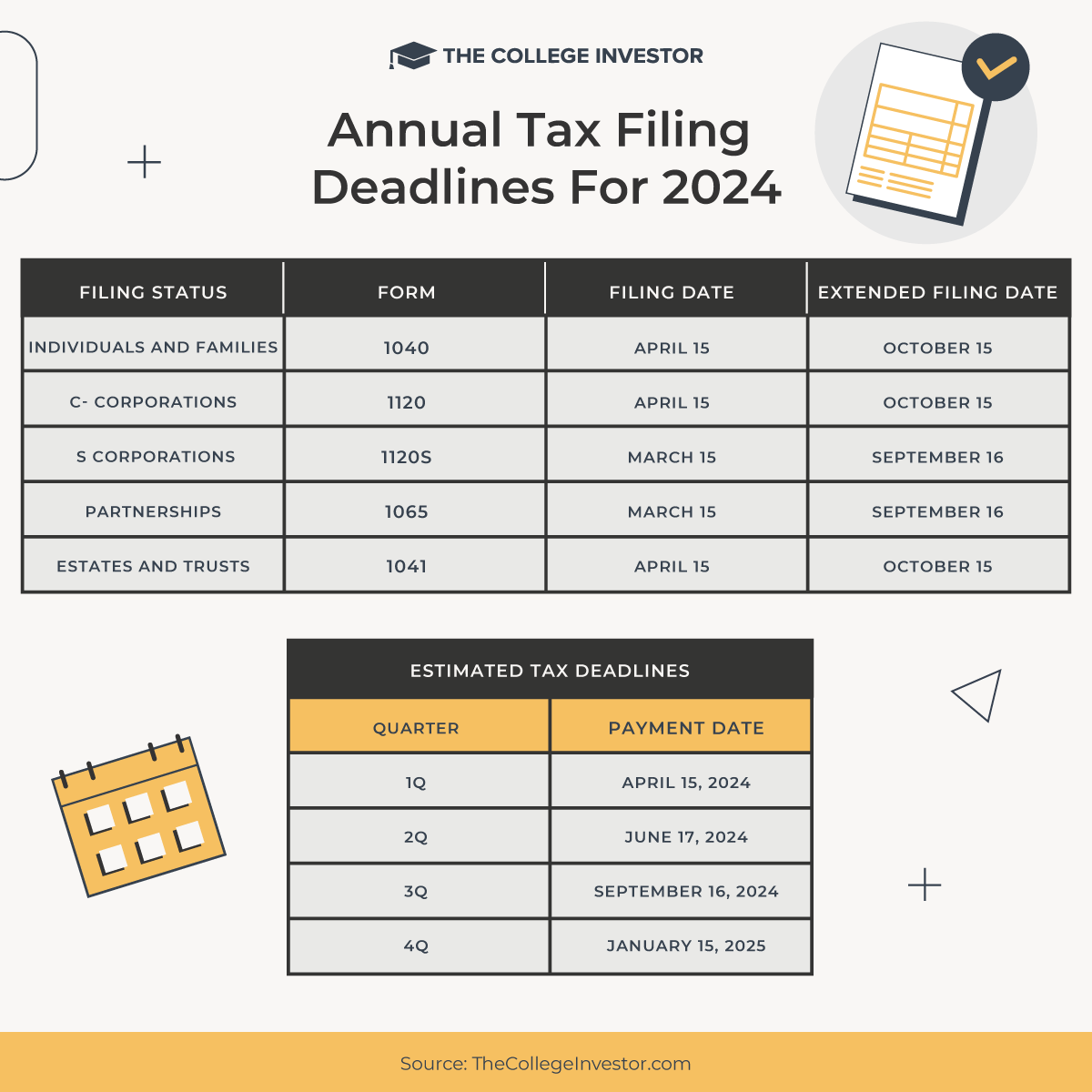

Annual Tax Filing Deadlines For 2024

Individuals and Families - Annual personal income tax filings (Form 1040) are due on Monday, April 15, 2024. The majority of people file a 1040.

Corporations (including S and C Corps) - C corporations (Form 1120) also file on April 15, 2024. S corporations (Form 1120S) and partnerships (Form 1065) file on March 15, 2024.

If you already filed your tax return, you can see when to expect your tax refund here.

Estimated Tax Deadlines For 2024

Payments for estimated taxes are due on four different quarterly dates throughout the year.

- 1Q — April 15, 2024

- 2Q — June 17, 2024

- 3Q — September 16, 2024

- 4Q — January 15, 2025

Federal estimated taxes can be paid at https://www.irs.gov/payments. Estimated state taxes can be paid through most state department of revenue websites. If not, you may need to mail in your payment.

Estates and Trusts

Estates and trusts file Form 1041. This is also due on April 15, 2024.

Extended Returns

Extended returns have different filing dates depending on the type of tax form being filed. You can request an extension, but that must be requested by the tax deadline above.

- Form 1065 extended return — September 16, 2024

- Form 1120S extended return — September 16, 2024

- Form 1120 extended return — October 15, 2024

- Form 1040 extended return — October 15, 2024

Filing Your Taxes

Where and how should you file your taxes? Most tax software will handle annual income tax filings and extensions. Check here for the best tax software.

Note that some of the free tax filing software may not offer as much customer service as paid versions. If you want specific questions answered or need guidance from a real person, be sure to check that those services are offered with the software.

If your taxes are fairly simple, filing online or through tax software is not difficult and will save your money. If your taxes are on the more complex side or you just don’t want to deal with filing, you’ll need to hire a tax professional, which will be more costly.

Tax professionals can be found locally, or you can visit any of the large tax brands such as H&R Block. Both have physical locations that allow you to speak to someone in person and have your questions answered.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Colin Graves