College Ave is a student loan lender that offers some of the best rates for private student loans and student loan refinancing.

Student loans are a necessity for many students seeking a higher education. The rising cost of higher education has led to over a million students graduating with debt. The clock starts ticking for these graduates as soon as they walk across the stage. They need to find gainful employment before their monthly student loan repayments begin or else face repaying your loan without a job.

Sometimes that can be difficult and payments may become a monthly burden. College Ave Student Loans is a company founded in 2015 by ex-Sallie Mae executives for the purpose of creating a better loan process. One particular goal is helping students save money on student loan repayments by refinancing existing loans.

College Ave also is one of our top private student loan lenders. See how College Ave compares here.

College Ave Student Loans are on the Credible platform for refinancing. You can quickly compare and see if they are the best in 2 minutes or less. Let's dive into our College Ave student loans review.

College Ave Student Loans

College Ave student loans offer competitive rates and some of the most flexible repayment options that you'll find. Here's a closer look at the terms and benefits.

Rates And Terms

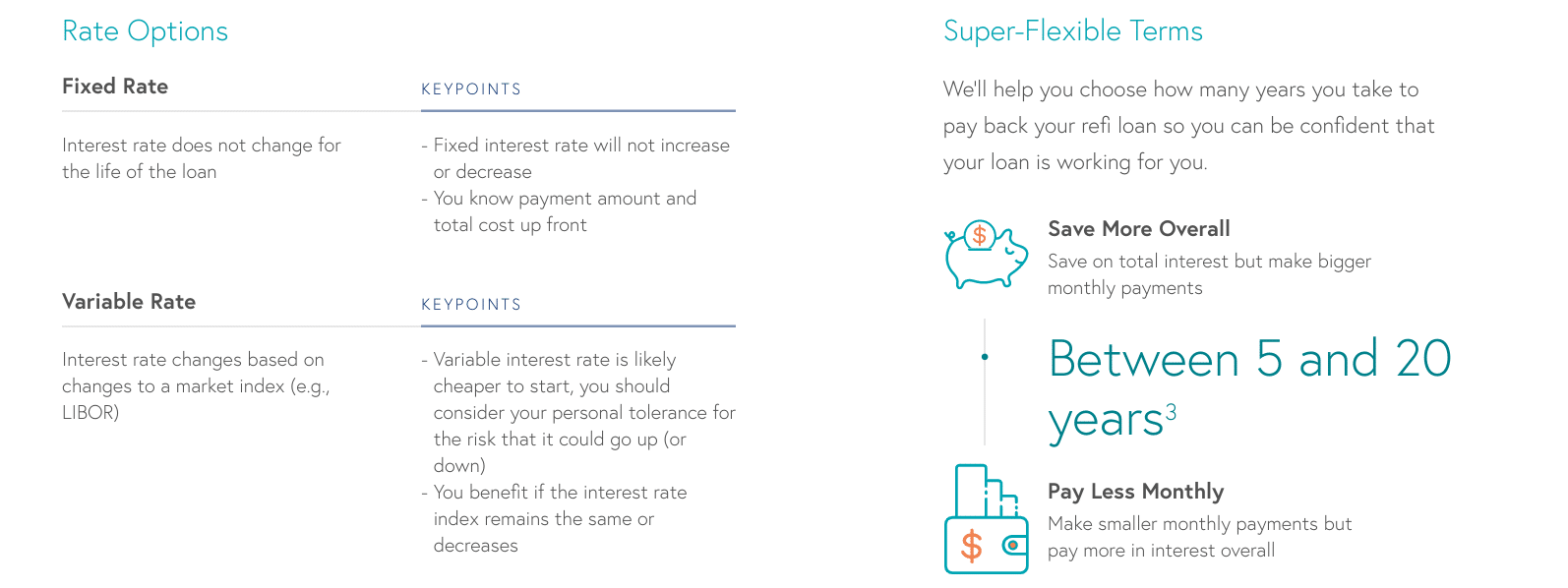

College Ave offers both fixed and variable rates on all of its private student loan products. Currently, its undergraduate loans offer the lowest starting interest rates. The variable rates, in particular, have the potential to be very affordable, with the low range of the spectrum nearly 1%.

- Variable APR: 5.59% - 16.85%

- Fixed APR: 4.29% - 16.69%

You'll have the option to pay back your private student loan in 5, 8, 10, or 15 years. The minimum loan amount is $1,000 and College Ave will cover up to 100% of the cost of attendance.

College Ave's general graduate loans and MBA loans both offer the same repayment terms as its undergraduate loans. However, they come with slightly higher interest rates. Here are their current APR ranges:

- Variable APR: 5.59% - 14.49%

- Fixed APR: 4.49% - 14.49%

Finally, College Ave offers medical, dental, and law school loans. These are the only private loans College Ave offers that can be repaid in 20 years. Here are their current rates:

- Variable APR: 5.59% - 14.49%

- Fixed APR: 4.49% - 14.49%

College Ave Details | |

|---|---|

Product Name | College Ave Undergraduate Private Student Loan |

Min Loan Amount | $1,000 |

Max Loan Amount | Up to the cost of attendance |

Variable APR | 5.59% - 16.85% |

Fixed APR | 4.29% - 16.69% |

Loan Terms | 5, 8, 10, 15, and 20 years |

Promotions | None |

Loan Repayment Options

College Ave offers a wide variety of repayment options that allow you to tailor a loan experience that works for you. Here are the options you have to choose from:

- Full principal and interest repayment

- Interest-only payments

- Flat $25 payments

- Deferred payments

The grace period on College Ave student loans is 6 months for undergraduate loans and 9 months for most of its graduate loan programs. Notably, College Ave also offers full deferment during medical and dental residency.

How Do College Ave Student Loans Compare?

College Ave is consistently near the top of the pack for private student loan lenders. They have flexible in-school repayment and even full deferment during residency. But that doesn't necessarily mean they'll be right for you. Check out this quick comparison here:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Minimum Loan | $1,000 | $1,000 | $1,000 |

APR Type | Variable and Fixed | Variable and Fixed | Variable and Fixed |

Cosigner | Not Required | Not Required | Not Required |

Earliest Cosigner Release Eligibility | Halfway Through Your Repayment Period | None | 24 Months |

Cell |

College Age Student Loan Refinancing

College Ave Refinance isn’t simply a consolidation company. When consolidating, you take several existing loans and combine them into one for lower monthly payments and, in some cases, lower interest rates. However, with College Ave, you can refinance a single loan to get better terms or lower rates.

Rates And Terms

With College Ave, you can refinance a loan as low as $5,000. The maximum loan amount for the vast majority of degree programs is $150,000. But if you have a medical, dental, pharmacy or veterinary doctorate degree, you can refinance as much as $300,000.

These low minimums and high maximums are what put College Ave on our list of the Best Places To Refinance Your Student Loans. Borrowers can choose from 16 different repayment terms, ranging from 5 to 20 years.

While that's not quite the level of customization that Earnest offers, it's still one of the most flexible refinance programs in the industry. Here are the current variable and fixed interest rates for College Ave's refinance loans:

- Variable APR: 6.99% - 13.99%

- Fixed APR: 6.99% - 13.99%

Remember, before you look at any rates, make sure you compare College Ave with other lenders. Using Credible, you can compare up to 8 lenders to make sure you get the best rate possible, including College Ave. Plus, College Investor readers can get up to an $1,000 bonus when they refinance with Credible. Check it out here.

College Ave Student Loan Refinancing Details | |

|---|---|

Product Name | College Ave Student Loan Refinancing |

Min Loan Amount | $5,000 |

Max Loan Amount | $150,000 or $300,000 (depending on degree) |

Variable APR | 6.99% - 13.99% |

Fixed APR | 6.99% - 13.99% |

Loan Terms | 5 to 20 years |

Promotions | None |

How Does College Ave Student Loan Refinancing Compare?

College Ave's student loan refinancing product offers 16 different repayment terms and high loan limits. But you'll still want to get rate quotes from a few additional lenders. Check out this comparison here:

Header |  |  | |

|---|---|---|---|

Rating | |||

Variable APR | 6.99% - 13.99% | 7.02% - 12.42% | 5.89% - 9.74% |

Fixed APR | 6.99% - 13.99% | 6.49% - 10.99% | 4.99% - 9.74% |

Bonus Offer | None | Up to $1,000 (via Credible) | None |

Cell |

Who Qualifies To Apply?

College Ave offers instant pre-qualification status and interest rate ranges. If you decide to move forward with a full loan application, the process is also streamlined and simple.

Before applying, consider the typical eligibility requirements you need to meet to qualify for a loan. For in-school student loans, you'll need to be at least 18 years old, a US citizen or permanent resident and attending an accredited school. Any students, regardless of enrollment status, can apply for loans. But you'll need to be enrolled at least half-time to qualify for in-school deferment.

For refinancing, College Ave does have a graduation requirement. However, it's more flexible than other lenders in that it doesn't require a bachelor's degree. This could make it a great option for borrowers who stopped their education after earning their associate degree.

Are There Any Fees?

As a low-fee provider, you won't have to worry about origination fees, origination fees, or prepayment penalties with College Ave. If a payment is more than 15 days late, however, a late fee of 5% or $25 (whichever is less) will be assessed.

How Do I Contact College Ave?

Unlike many lenders, College Ave actually self-services its loans. So if you have any questions about your bills or payments, you can simply reach out to its customer support team.

To talk with someone over the phone, call 844-803-0736 from 8 AM to PM (ET), Monday - Friday. College Ave also offers live chat, SMS support at 855-910-0510, and email support at servicing@collegeave.com.

Is It Safe And Secure?

College uses Secure Socket Layer (SSL) technology to secure its website and the information that it collects. It also gives customers several options to control the use of their personal data. You can request disclosure of your data here and deletion of your data here. To make a "Do Not Sell My Info," fill out this form.

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is This For And Is It Worth It?

College Ave student loan offers some in-school products and a viable refinancing option. The company is a solid lender to who just recently started offering both fixed rate and variable rate student loans.

Make sure you compare them using Credible to other lenders before making a decision. Don't forget, College Investor readers get up to a $1,000 bonus when they refinance with Credible. Check it out here.

Make sure you check out our Student Loan Refinancing Tool to compare all of the different student loan lenders.

College Ave FAQs

Let's answer some common questions about College Ave.

Is College Ave student loans legit?

Yes, College Ave is a real lender that has been providing private student loans and student loan refinancing since 2015. It offers some of the most flexible repayment terms on the market and it says that 99% of its borrowers are making on-time payments.

Is College Ave a federal student loan?

No, College Ave only offers private student loans, which means they aren't eligible for any of the federal income-driven repayment plans or forgiveness programs.

Does College Ave affect your credit score?

Checking your pre-qualified interest rate with College Ave won't have an impact on your credit score. However, if you decide to move forward with a full loan application and hard credit inquiry, your credit score will be affected.

Do you have to be a graduate to refinance with College Ave?

Yes, you'll need to have an associate's degree or higher to qualify for College Ave student loan refinancing.

Can you pay off a College Ave loan early?

Yes, you can pay off your loan at any time and College Ave never charges prepayment penalties.

College Ave Features

Min Loan Amount |

|

Max Loan Amount |

|

Pre-Qualified Rates (Soft Credit Check) | Yes |

Autopay Discount | 0.25% |

Loan Terms |

|

Origination Fees | None |

Prepayment Penalty | No |

In-School Payments |

|

Late Payment Fee | 5% of the amount due or $5 (whichever is less) |

Cosigners Allowed | Yes |

Cosigner Release | Yes, but can only be requested after half of the scheduled repayment period has elapsed. |

Grace Period | Yes, 6 to 9 months |

Eligible Schools | Title-IV accredited schools |

Enrollment Status (For Student Loans) | Full-time, half-time, or below half-time *Enrollment status of at least half-time required to qualify for in-school deferment |

Graduation Requirement (For Refinancing) | Yes, associate's degree or higher |

Customer Service Phone Number | 844-803-0736 |

Customer Service Hours | Monday - Friday, 8 AM to PM (ET) |

Loan Servicer | College Ave |

Address For Sending Payments | College Ave Student Loans |

Promotions | None |

College Ave Student Loans Review

-

Rates And Fees

-

Application Requirements

-

Customer Service

-

Features And Services

Overall

Summary

College Ave offers private student loans and student loan refinancing. It provides a high level of repayment flexibility and tends to offer some of the most competitive rates.

Pros

- Low rates for qualified borrowers

- Full medical residency deferment

- 16 repayment terms on refinance loans

- Will refinance associate’s degree loans

Cons

- Only offers 12 months of forbearance

- Can’t release a cosigner until half of the repayment period has elapsed

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett