With college becoming more expensive, how can parents afford to send a kid to school?

More than a decade after completing college, 7% of Millennials still have more than $50,000 in student loan balances. Facing our reality of digging out of debt and knowing our friends' horror stories, many millennials are motivated to help their kids get through college debt-free.

While we can’t promise that you’ll be able to help your child avoid debt, we’ve got realistic tips to cover the cost of college from the day your child is born to after they graduate.

How To Save For College When Your Kid is A Baby

When you have a newborn snuggling in your arms, college seems like it's a lifetime away. And with the new costs of being a parent, saving for college may not seem like a priority. With a baby, money is undoubtedly tight. You’ve either started paying for child care, or you’re working less to care for your little one. Still these are a few things you can do to help your baby graduate from college debt-free.

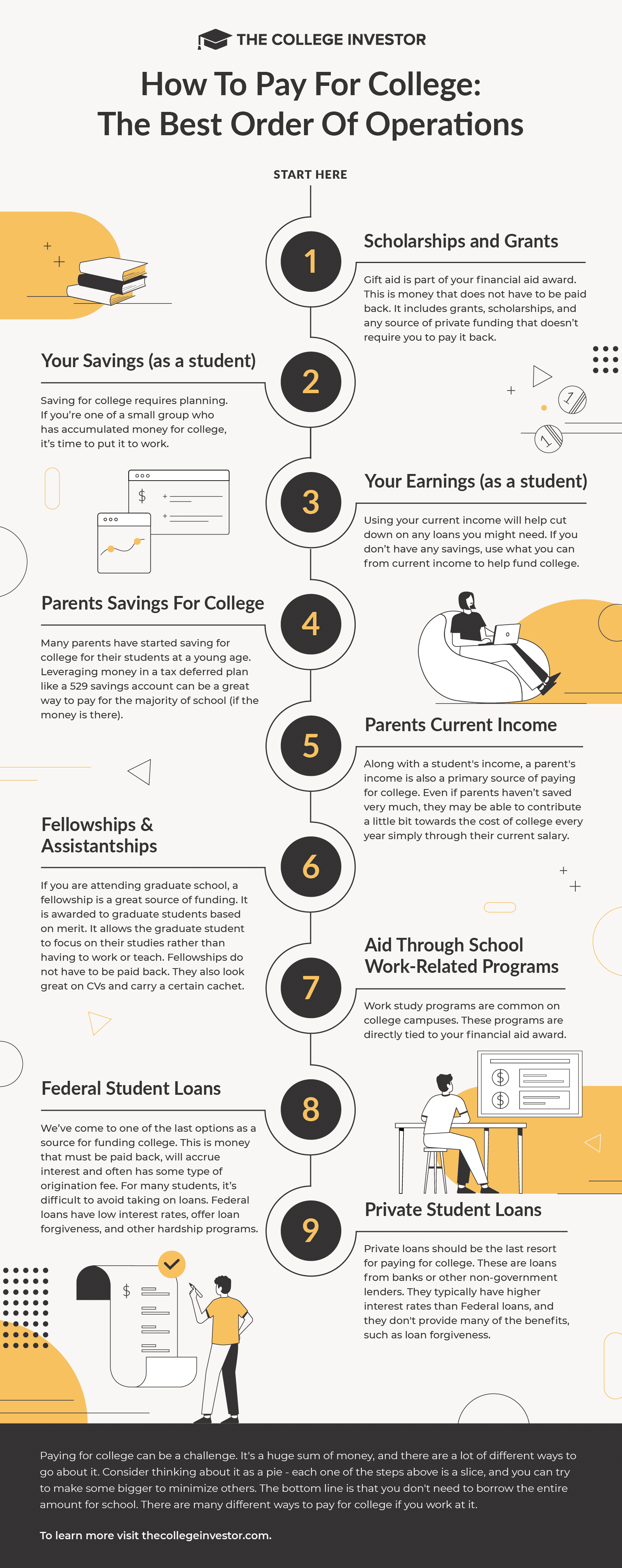

Open a 529 Account. A 529 Account allows you to invest money for your child’s education. Any money that you put in the account will grow tax-free, and you don’t have to pay taxes or penalties if the money is spent on education costs. If you happen to put too much money into the account, your child can put up to $35,000 into a Roth account after they turn 18.

Set up an automatic $10 weekly contribution to the account. Your budget may feel like it's squeezed, but most people can afford $10 per week, and if you contribute this much to the 529 accounts, and get a 7% return, you’ll have $18,000 in the account by the time your child starts school.

Put any financial gifts into the account. People often give small financial gifts to kids for birthdays, Christmas, or major milestones. It’s easy to spend this money but invest it in the 529 instead. Between a $250 initial contribution and $10 weekly deposits, you’ll have close to $20,000 to pay for school when your child turns 18.

These tips aren’t going to get your child through college without debt, but they go a long way toward helping them. And combined with some of the strategies later in life, you may be able to put your kid through college without debt.

College Savings During Elementary School

When your child first hits elementary school, you’ll have just over a decade before they start college. By the end of 5th grade, they have just seven school years left before college. Your focus is likely on enjoying art projects, Lego creations, soccer games, and playgrounds with your kid, but you can take these steps to save for college in the back half of your kid's childhood.

Use a UPromise Credit Card. A UPromise credit card allows you to save cash-back into your child’s 529 account. It won’t add up to a ton of money, but every little bit helps.

If you’re not paying for childcare anymore, increase your weekly contribution to your 529 account. Assuming you start contributing $10 per week when your child is born, you’ll have $3900 by the time your child is 6. If you can boost your contribution to $50 per week at that point, you’ll have nearly $58,000 by the time you send them to college.

Start teaching your kids about financial basics such as earning, spending, and saving money now.

College Savings During Middle School

While much has changed since I was in Middle School, it still seems like these early adolescents are eager to spend their parents' money on the latest tech, new sneakers, and junk food. During middle school, it would be easy to let college savings take a back seat as you negotiate more daily money management with your newly minted teenager. These are a few things you can do to boost your college savings since it likely seems a lot closer now than it did at the end of fifth grade.

Continue automated contributions to the 529 account. If you haven’t been contributing, it’s still worthwhile to start saving for college when you have a middle schooler. You won’t see dramatic growth, but it will give them a hand up when it comes time to start school.

Emphasize opportunities to earn money. Middle schoolers can’t have part-time jobs, but they can typically find plenty of odd jobs to help them earn money. Teens who spend time babysitting, shoveling snow, mowing lawns, cleaning windows, or helping with the family business will have an appreciation for money that other kids won’t have.

Teach your teen about investing by allowing them to open a brokerage account if they have extra cash. As a warning from personal experience, your teen may not be interested in lessons about prudent investing in a diversified investment portfolio. Let’s hope that comes later on.

College Savings During High School

By the time you have a high schooler, you should know whether they are likely to attend college after graduation. If they seem college-bound, you’ll want them to start taking on some of the work associated with paying for college. These are a few things you can encourage your high schooler to do to help pay for college.

Start looking into scholarships. I’m always surprised by the number of scholarships available to high schoolers, especially juniors and seniors. Many of these scholarships are local scholarships worth $50-$250, but these types of scholarships can add up.

Consider dual-enrollment options. Typically, dual-enrollment involves taking classes at a local community college or university. You get credit for both high school and college at the same time. Most of the time, the credits are directly transferable to a four-year university.

Talk about college affordability. For decades, most people encouraged high school students to attend the best college they could. But with the rise of student debt, school affordability is finally in vogue. College affordability isn’t just about list price. So encourage your high schooler to apply to pricey schools like Harvard or NYU. But be realistic about the costs. If they are accepted but don’t get merit aid from the school, those expensive schools may be out of reach for you.

Encourage your high school student to save money. Most high schoolers can handle a part-time job along with their academic and extracurricular obligations. If you’re covering most of their needs, your kids should be able to save some money. Saving a few thousand dollars during high school could allow your child to buy a laptop, books, and other essentials that they need to start college with minimal debt.

Paying for College During College

College savings doesn’t stop when high school ends. Parents can (and often do) support their kid’s education costs during college as well. These are a few things parents can do to help their college-aged kids pay for college.

Complete the FAFSA. Most colleges require you to complete the FAFSA to receive merit or need-based aid. And if you can’t completely cover the cost of college, you may qualify for subsidized student loans from the Department of Education.

Choose your college based on affordability. There’s no shame in choosing a school that you can afford. If the flagship university in your state costs twice as much as regional campuses, you may want to attend the regional campus. Use the community college system to get your general education requirements out of the way for a minimal cost. If your student wants to attend a pricier school, make sure they have plenty of scholarships to cover the bulk of the costs (that you can’t cover).

Talk about loans with your student. Student loans may allow your child to get a valuable degree, but student loans are still debt. You will want your child to understand that loans aren’t free money. Encourage them to minimize the debt they take out.

Get creative about covering costs. Help your student create a budget that will minimize the need for debt. If they live at home, go car-free, or get scholarships they may not need to work as much during college. On the other hand, if they have lots of income-earning opportunities, they may be able to handle tuition and living expenses without burdensome debt. As a parent, you may be able to help them get creative too.

Pay for education costs out of your 529 account. If your child’s 529 account has money, this is the time to use it. Even if you don’t have enough to cover tuition, books, room, and board for four years, you may be able to keep your student out of debt for a year or two, and that’s a huge blessing.

Don’t take on Parent PLUS loans. A sure sign that a college is unaffordable is if you need to take out Parent PLUS loans to cover the costs. Undergraduate students should be able to cover costs with savings, scholarships, and loans in their names. If they can’t, a lower-cost option is in order.

Don’t neglect your retirement savings. Most financial experts advise prioritizing your retirement savings above saving for your children’s education. By investing for your retirement, you can avoid becoming a financial burden to your children in your later years.

Paying for College After College

If your student took out loans to cover undergraduate costs, you may want to help them pay back their loans. These are a few ways you may be able to help.

Let them live at home. If your kid spends a few years at home, they may be able to eliminate their debt burden before moving out. Make sure that you and your child both agree that the goal is to get out of debt.

Direct your previous savings to their debt. Any money you can direct towards your child’s debt will be a big help to them. If you’re used to giving them $50 per week, start directing that $50 per week towards their debt. This is a great way to help them get out of debt quickly.

Carefully consider large cash transfers. Once you reach retirement age, you can start to withdraw money from retirement accounts without penalties. If you have a lot of money stocked away in these accounts, you may want to liquidate some investments and pay off your kids' student loans. This is an area where you want to tread carefully. A fiduciary financial advisor can help you decide if this is the right thing for you to do.

Conclusion

Helping your kids through college is a noble goal, and you can take steps to help them avoid or minimize student debt. No matter what age your kids are, you may be able to help them afford their post-secondary education.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Ashley Barnett